Trump Tariffs on Financial Services and Stock Investments: What You Need to Know

Understanding the Potential Impact of Trump Tariffs

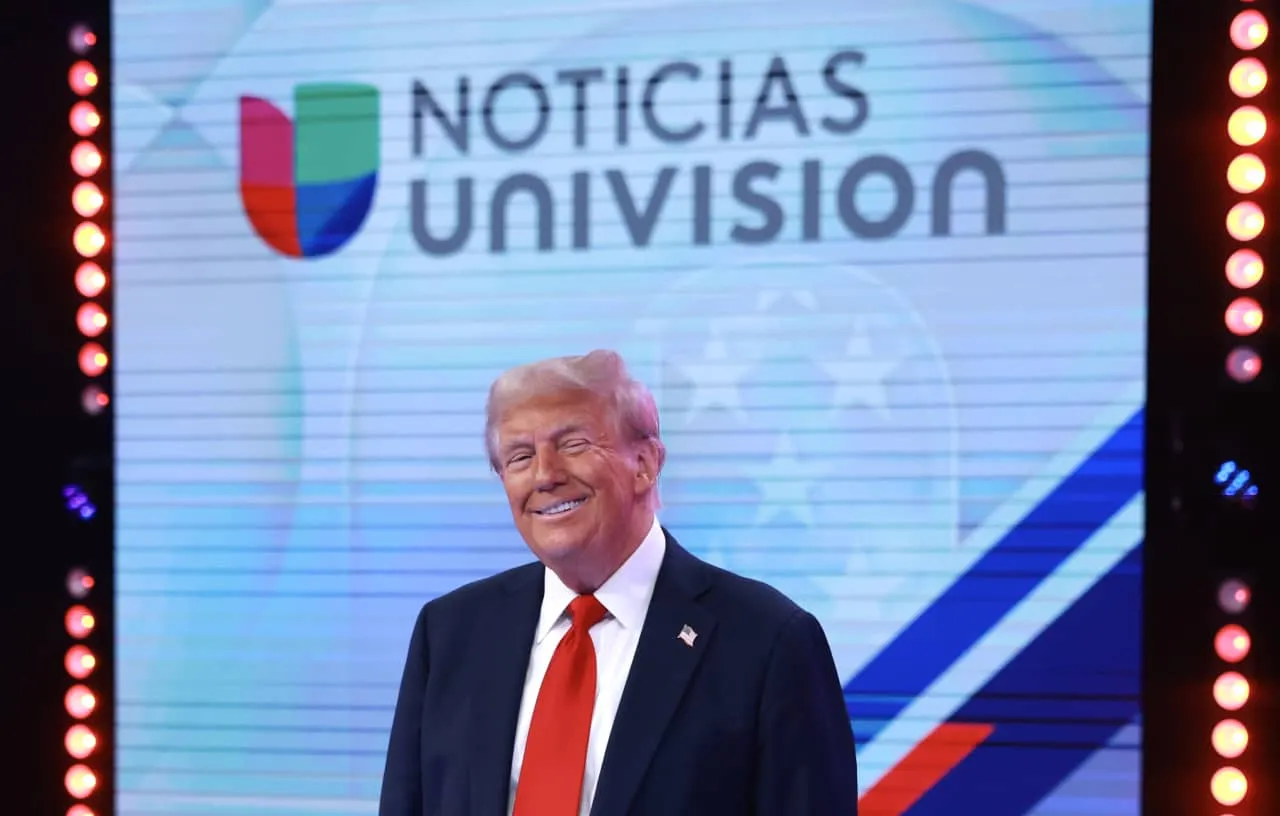

As Trump re-emerges as a presidential candidate, the prospect of universal tariffs is becoming increasingly likely. Observers in the financial services and investing securities sectors are particularly concerned about the ripple effects on equity markets, debt/bond markets, and trade barriers.

Sector Analysis: Which Markets Will Be Hit Hardest?

- Equity Markets: Stocks such as technology and consumer goods may face backlash due to increased costs.

- Debt Markets: Higher tariffs could lead to rising interest rates, impacting bonds and overall corporate debt.

- Commodity Markets: Prices may surge as tariffs complicate trade routes and supply chains.

Furthermore, analysts caution about the implications for labor issues and domestic politics as tariffs reshape industry landscapes.

Conclusion: What to Watch In the Coming Weeks

Market participants should keep a close eye on political developments and analyst recommendations pertaining to these sectors to understand the evolving landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.