Logista: Pharmaceuticals & M&A Potential Amid Tobacco Threats

Exploring Logista's Prospective Value

Logista is intriguing for its ability to leverage its strengths in pharmaceuticals and M&A. Even with the low-margin nature of its business, the absence of debt allows for a strong foundation. This financial flexibility potentially enables the company to return value to shareholders or pursue strategic acquisitions.

Market Opportunities and Strategic Moves

Logista's robust free cash flow enhances its attractiveness for investors. Here are some vital elements at play:

- No Debt: This grants financial agility.

- Free Cash Flow: A powerful enabler for M&A activity.

- Pharmaceuticals Potential: A sector with upsides despite challenges.

The company’s strategic posturing suggests a readiness to engage in acquisitions that could bolster its market position.

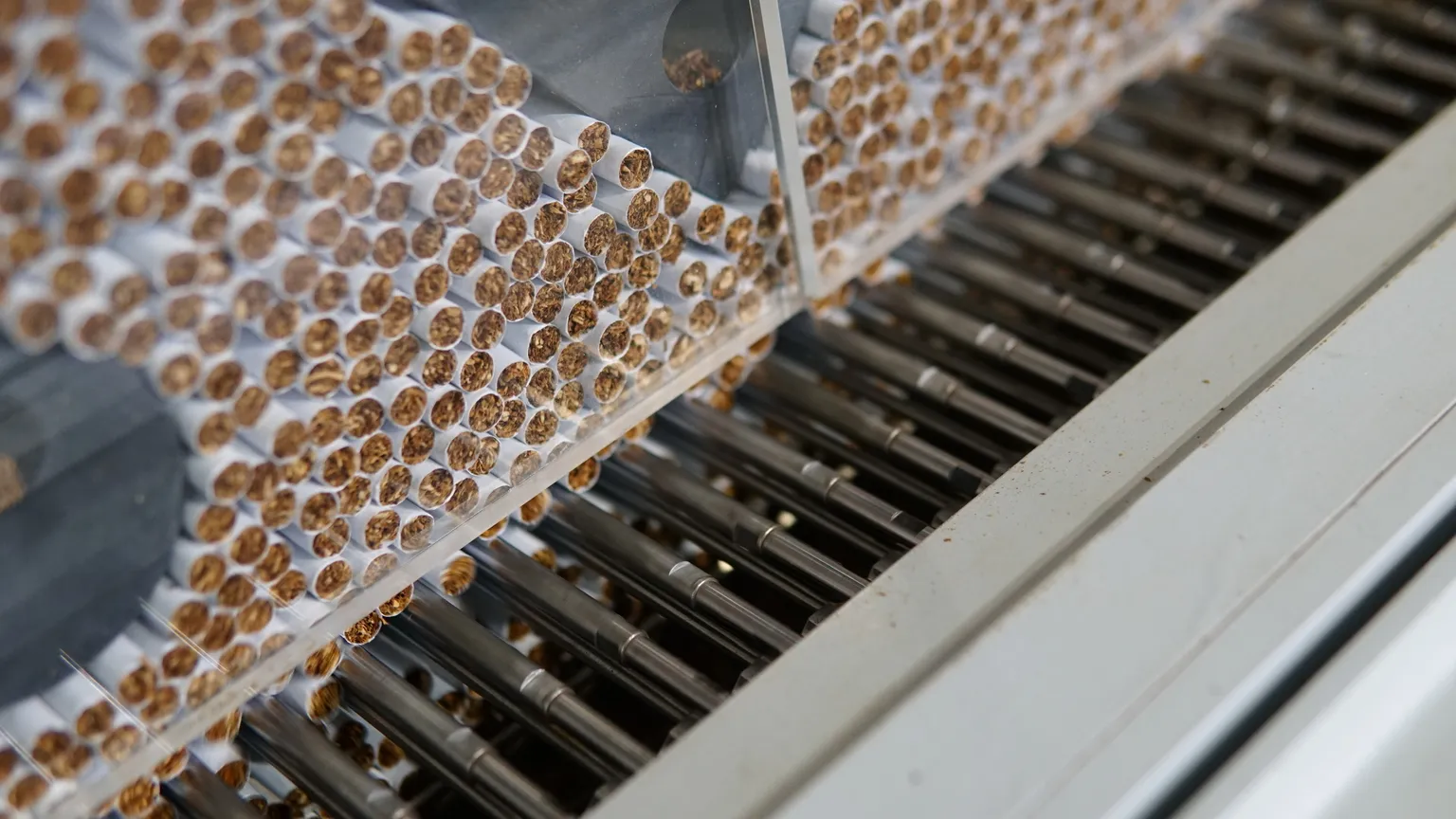

Cautious Outlook on Tobacco Risks

While opportunities are abundant in pharmaceuticals and M&A, tobacco risks continue to linger. These risks could impact market perceptions and investor sentiment, necessitating cautious monitoring.

Investors should stay informed about how Logista navigates these threats while capitalizing on its strengths.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.