Opinion on the Fed’s Rate Cut Trajectory and Its Implications for Cryptocurrency

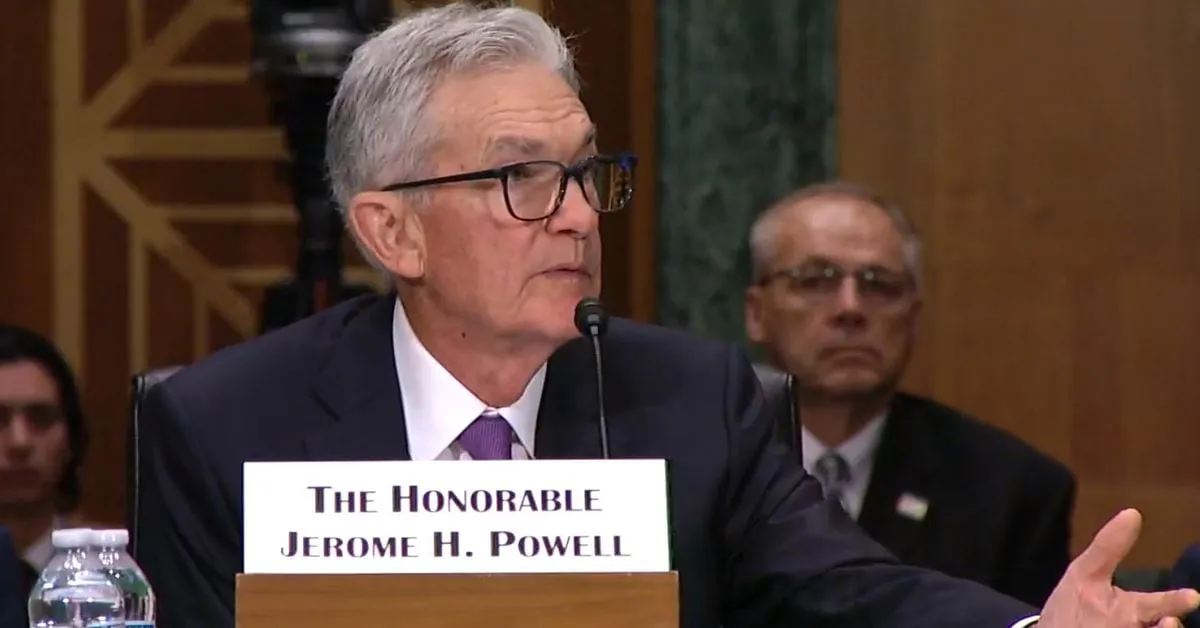

Understanding the Fed’s Rate Cut Trajectory

The Fed’s trajectory for rate cuts is gaining attention as inflation trends approach pre-pandemic norms. This shift is pivotal, providing more latitude for policymakers to maneuver in interest rates. Lower rates can energize various sectors, particularly cryptocurrency investments, which thrive in favorable economic conditions.

The Impact on Cryptocurrency

With the potential for lower interest rates, investors are likely to seek alternatives, including cryptocurrencies. As traditional returns diminish, the crypto market may experience heightened interest and investment.

- Increased Risk Appetite - Investors may broaden their portfolios to embrace crypto assets.

- Price Volatility - Anticipated shifts could trigger price fluctuations in the crypto market.

Future Considerations

As the economic landscape evolves, so do investment strategies. Keeping an eye on the Fed’s movements will be crucial for those involved in digital currencies.

For more insights on economic trends and their implications, keep following financial updates.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.