Exploring the Surge in DeFi Lending Amid Market Liquidations

Understanding the Surge in DeFi Lending

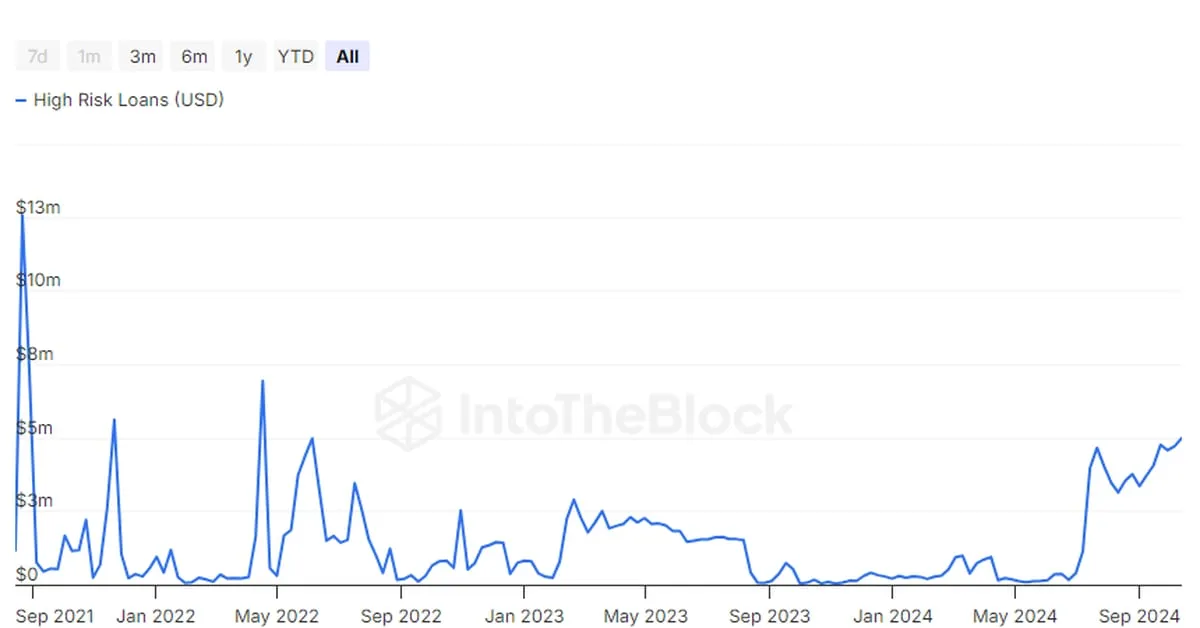

The cryptocurrency markets have witnessed a dramatic rise in high-risk lending, as the total amount of loans collateralized by crypto that are within 5% of their liquidation price now stands at $55 million. This represents a significant trend in the trading landscape, where traders are increasingly drawn to high-leverage opportunities amidst market volatility.

Market Dynamics Driving Liquidations

The surge in DeFi lending is not without its risks. As markets churn, the potential for liquidation amplifies, posing threats to many traders. Key factors influencing this trend include:

- Increased adoption of DeFi platforms

- High volatility in cryptocurrency prices

- Market sentiment and speculative trading

Implications for Traders

For those participating in these high-risk loans, understanding the landscape is crucial. The balance between opportunity and danger is precarious, and maintaining awareness of market conditions is essential for trading strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.