ROBO ETF Analysis: A Consumer-Centric Approach to Investment

Thursday, 17 October 2024, 02:50

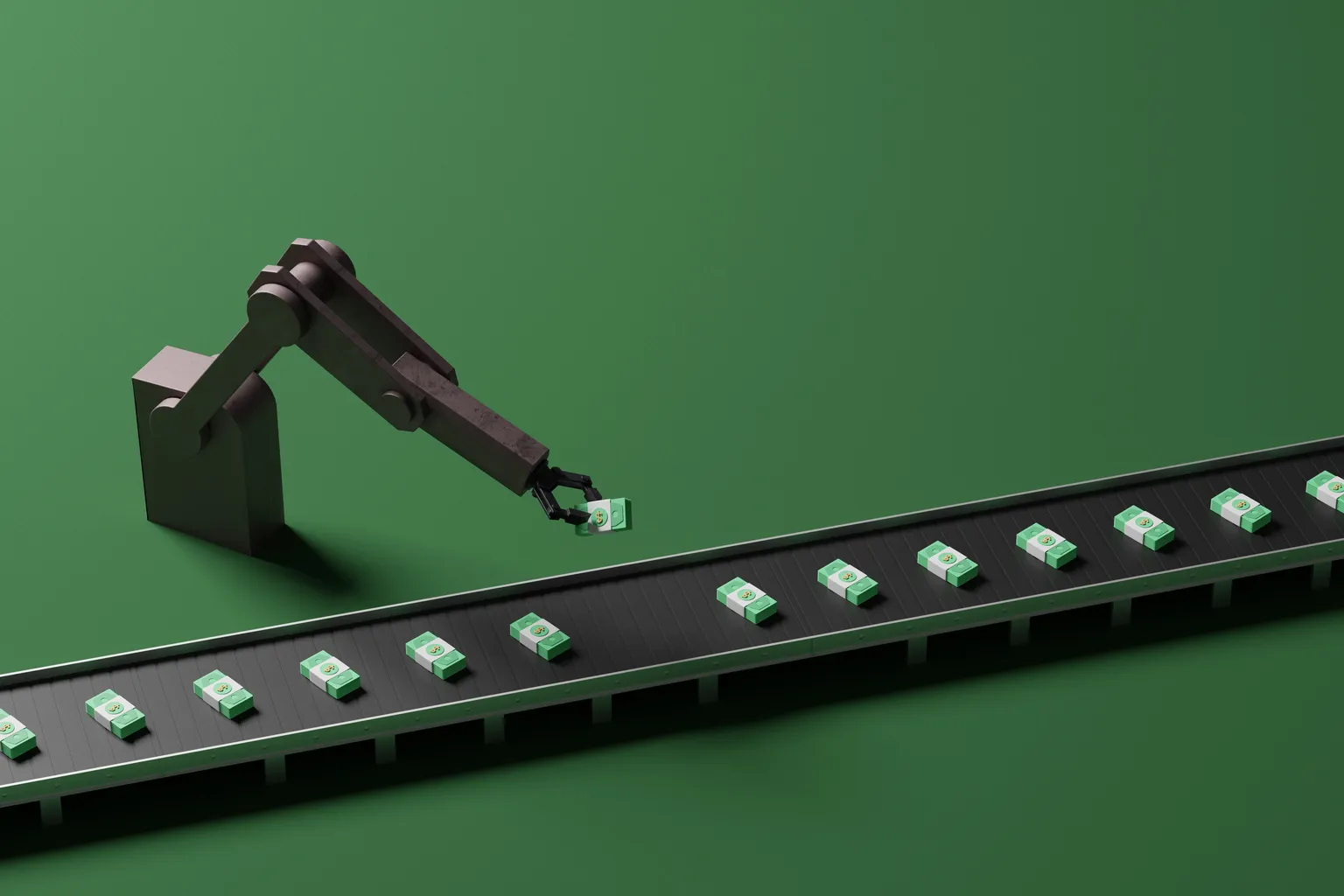

Understanding the ROBO ETF

The ROBO ETF is centered on consumer-facing technology, challenging traditional models that prioritize innovation over market demand.

Potential Benefits of Investing in ROBO ETF

- Diverse Exposure: Provides exposure to various sectors utilizing automation.

- Consumer-Oriented: Focuses on companies that serve consumer needs directly.

- Growth potential in industries likely to benefit from automation.

Risks and Considerations

- Market Volatility: Potential fluctuations in consumer spending impact performance.

- Sector-Specific Risks: Exposure to specific industries can lead to concentrated risk.

- Comparative performance analysis against S&P 500 raises concerns.

Final Thoughts on ROBO ETF

Investors should weigh the potential benefits against the inherent risks in the ROBO ETF before committing to their investment strategies. For long-term growth, aligning with consumer needs may prove advantageous.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.