Finance Influencer Faces Backlash: The Debate Over SIPs vs. Car EMIs

Finance Influencer Sparks Debate

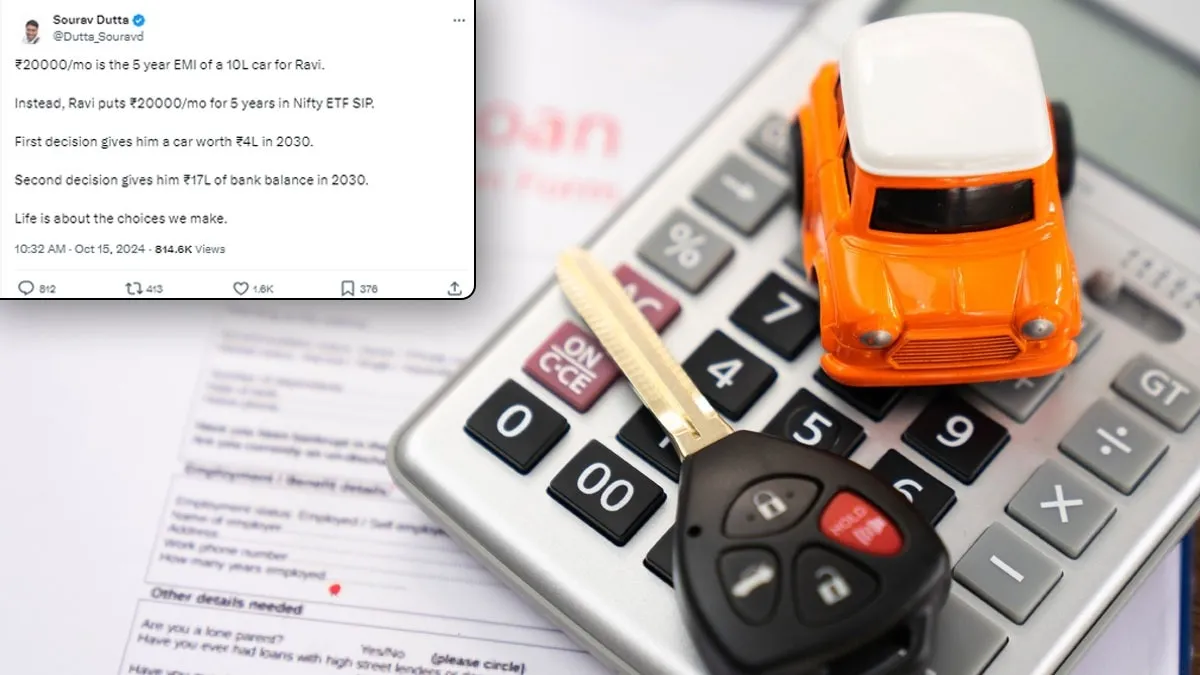

An influential figure in personal finance, Sourav Dutta, is facing significant backlash after advising his followers on social media to invest in SIPs instead of purchasing a car. In a recent post on X, Dutta suggested that by contributing Rs 20,000 per month into an Nifty ETF SIP for five years, one could achieve greater financial security compared to taking out an EMI for a car. Dutta's statement claiming that this investment could yield Rs 17 lakh by the year 2030, while purchasing a car would leave one with only Rs 4 lakh, ignited a storm of criticism around the practicality of his advice.

Public Reaction to Dutta's Advice

Critics, including Maharashtra-based entrepreneur Chirag Bhajatya, highlighted the necessity of a car, especially during emergencies. Bhajatya recounted a harrowing incident during the pandemic where having a car was vital for accessing healthcare, arguing that financial advice should also consider real-life situations. Other social media users echoed similar sentiments, pointing out that life is not solely about savings but also about enjoying experiences and meeting immediate needs.

Key Points Raised by Critics

- Importance of balancing savings with immediate necessities.

- Criticisms highlighted situations where vehicles are essential for emergencies.

- Discussion reflects broader issues of financial advice applicability.

The ongoing discussions underscore a critical aspect of financial planning: while long-term savings like SIPs are important, there is equally a need for financial tools that cater to unexpected life challenges.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.