Are Investors Offered a Rare Entry Point into ASML After Earnings? Insights and Analysis

Market Conditions and ASML's Position

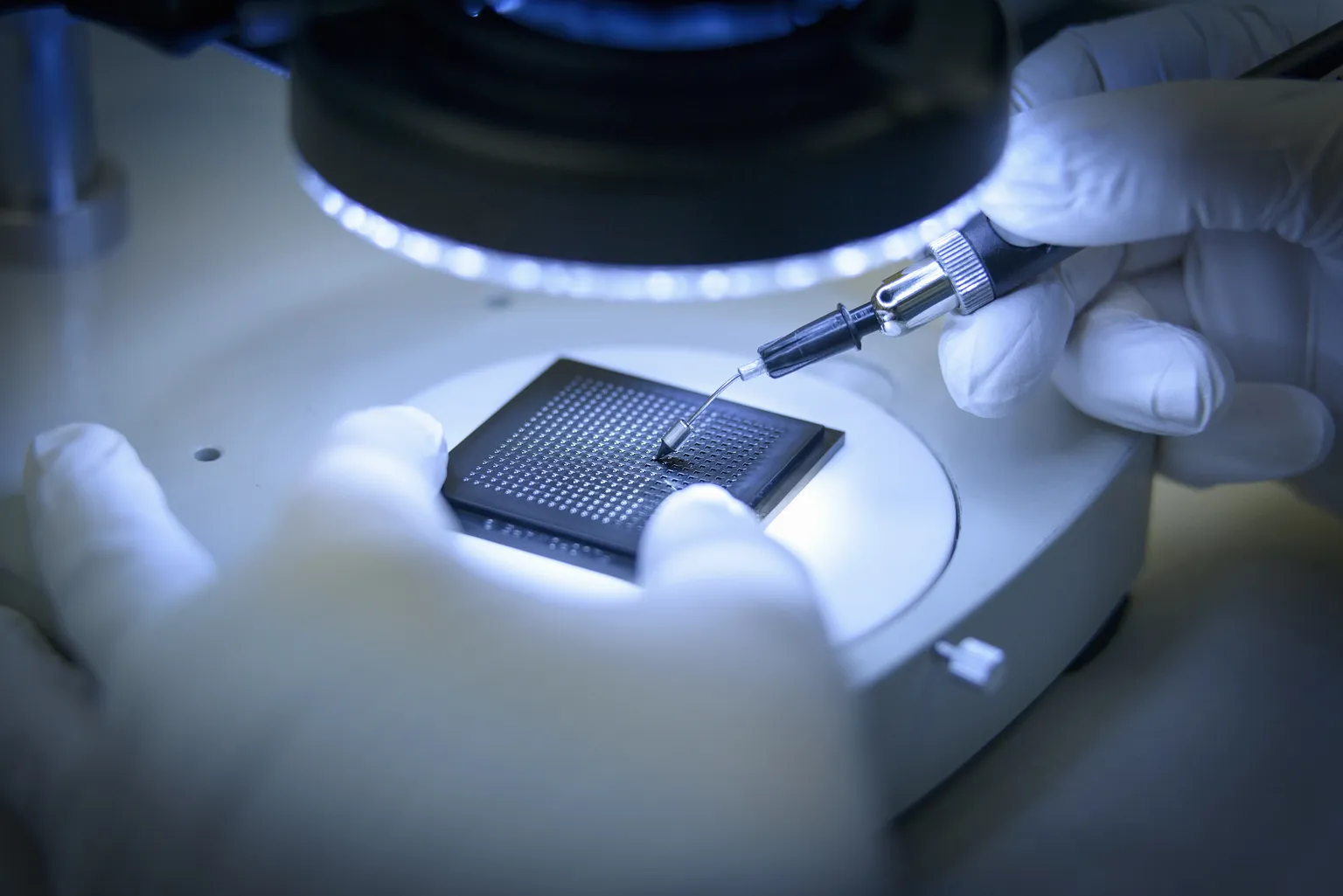

ASML, a leader in advanced lithography technology, is facing a unique moment in the market. After reporting earnings, the company experienced a significant 20% share price decline. This downturn, attributed to cautious growth forecasts, raises questions about investor sentiment and overall market dynamics.

Understanding Market Response

The swift drop in ASML's stock price can be seen as a reaction to broader market trends. Here are some key points to consider:

- Monopoly in Lithography: ASML's unique position in advanced lithography technology underscores its potential for recovery.

- Growth Forecasts: The cautious outlook has led to investor hesitance, but could this also indicate an opportunity?

- Investment Timing: For savvy investors, this may represent a rare entry point into ASMIY stock.

Investor Considerations

Navigating the implications of this price drop requires a closer look at several factors:

- Market Trends: Assessing the broader economic landscape can provide insights into potential recovery.

- P/E Ratios: Evaluating ASML's price-to-earnings ratios could shed light on its valuation post-drop.

- Long-term Growth: Investors should consider ASML's historical performance and future potential.

In conclusion, while the cautious growth forecast has created turbulence for ASML, it simultaneously may offer a compelling entry point for investors. To stay informed and make strategic decisions, one should continuously follow the evolving market dynamics.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.