Recovering Money Stolen: 401(k) Check Fraud Insights

Understanding 401(k) Check Fraud

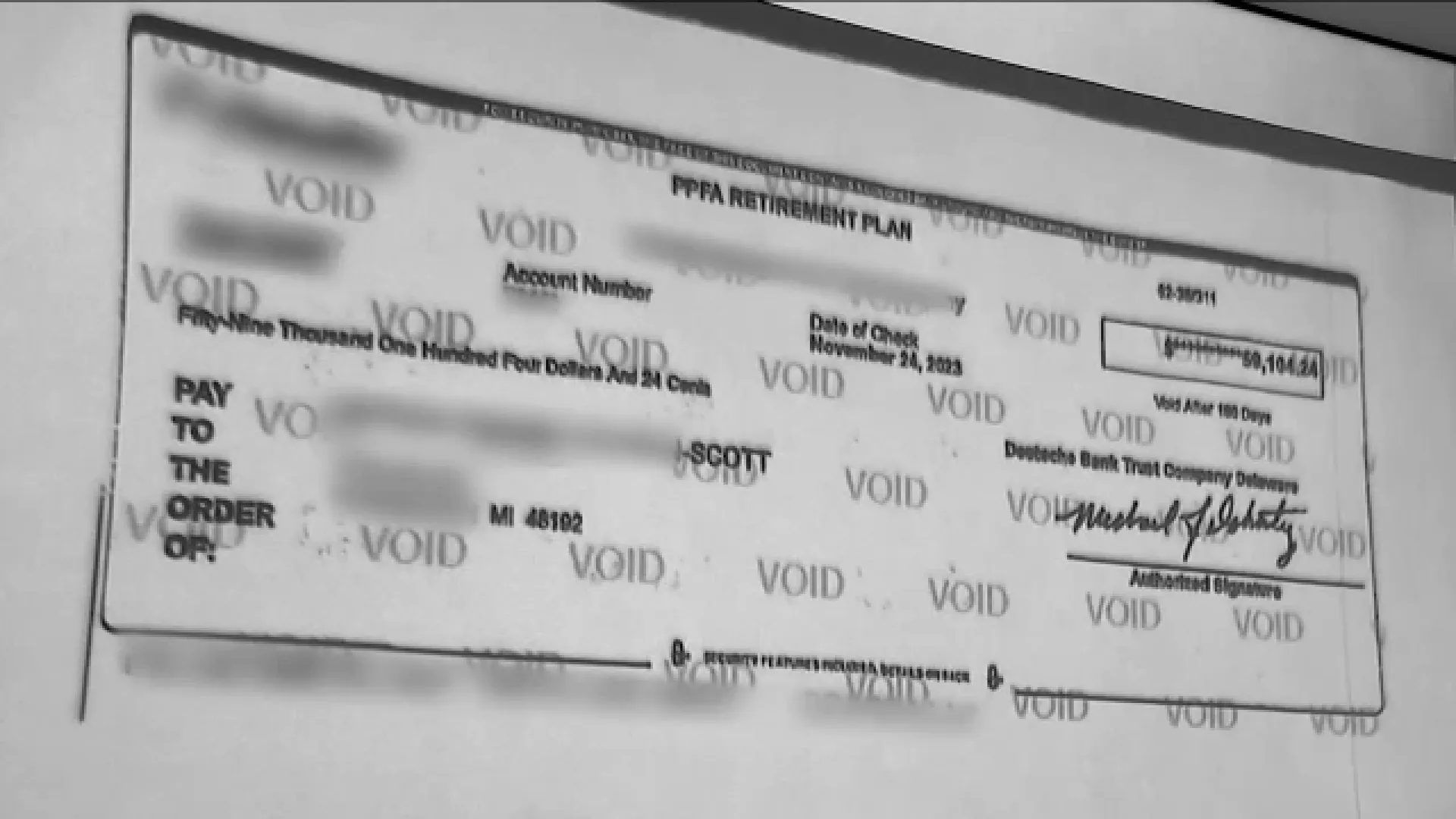

The issue of check fraud continues to plague many unsuspecting individuals, leading to significant financial losses including their 401(k) savings. A recent case highlighted by 7 On Your Side showcases how a man's funds—including employee matches—were drained due to these deceptive tactics.

Signs of Money Theft

- Check washing incidents where checks are altered.

- Stolen checks often lead to rapid disappearance of funds.

- Maintaining vigilance can prevent such monetary losses.

Moving Forward After Theft

After experiencing money theft, it is crucial to transfer money securely and monitor accounts closely. Resources like 7 On Your Side offer insights and solutions. Here are steps to protect your future:

- Regularly check account statements.

- Report suspicious activity immediately.

- Utilize fraud protection services.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.