DailyMail Money Mortgages Home: Latest Base Rate Forecasts Impacting Your Finances

Understanding the Upcoming Interest Rate Cuts

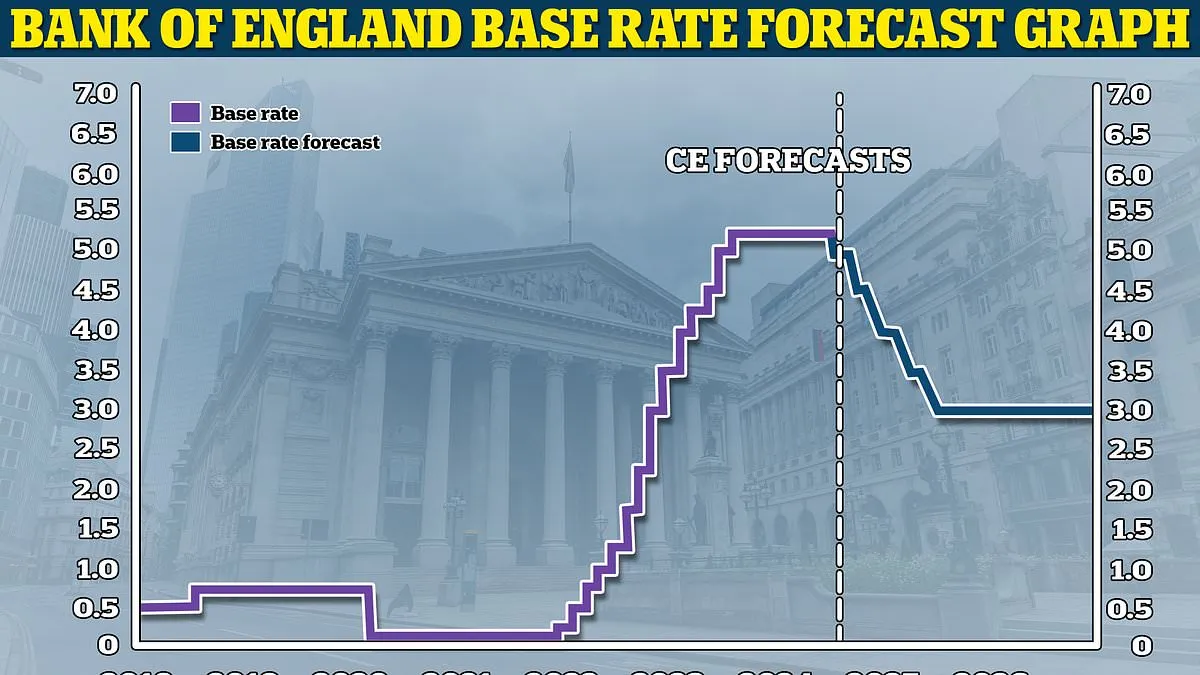

As inflation has finally decreased below the Bank of England's target, discussions around potential interest rate cuts are heating up. Following years of elevated rates, the prospect of lower borrowing costs is becoming a hot topic among economists.

Forecasting the Base Rate Changes

The current financial landscape suggests that the central bank might take action soon. Analysts predict significant shifts in the money market to accommodate the evolving economic conditions.

- Interest rates could be reduced as early as next month.

- Monitoring inflation figures is crucial for real-time insights.

- The effects of these changes can vary across mortgages and home financing options.

Implications for Homeowners and Borrowers

These potential interest rate adjustments bring a new wave of opportunities for homeowners, especially those looking to refinance or enter the housing market. Financial planning becomes vital in leveraging these upcoming rate changes.

Stay Updated on Financial Trends

To navigate these potential changes effectively, keep an eye on financial news and consider consulting with financial advisors for personalized advice.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.