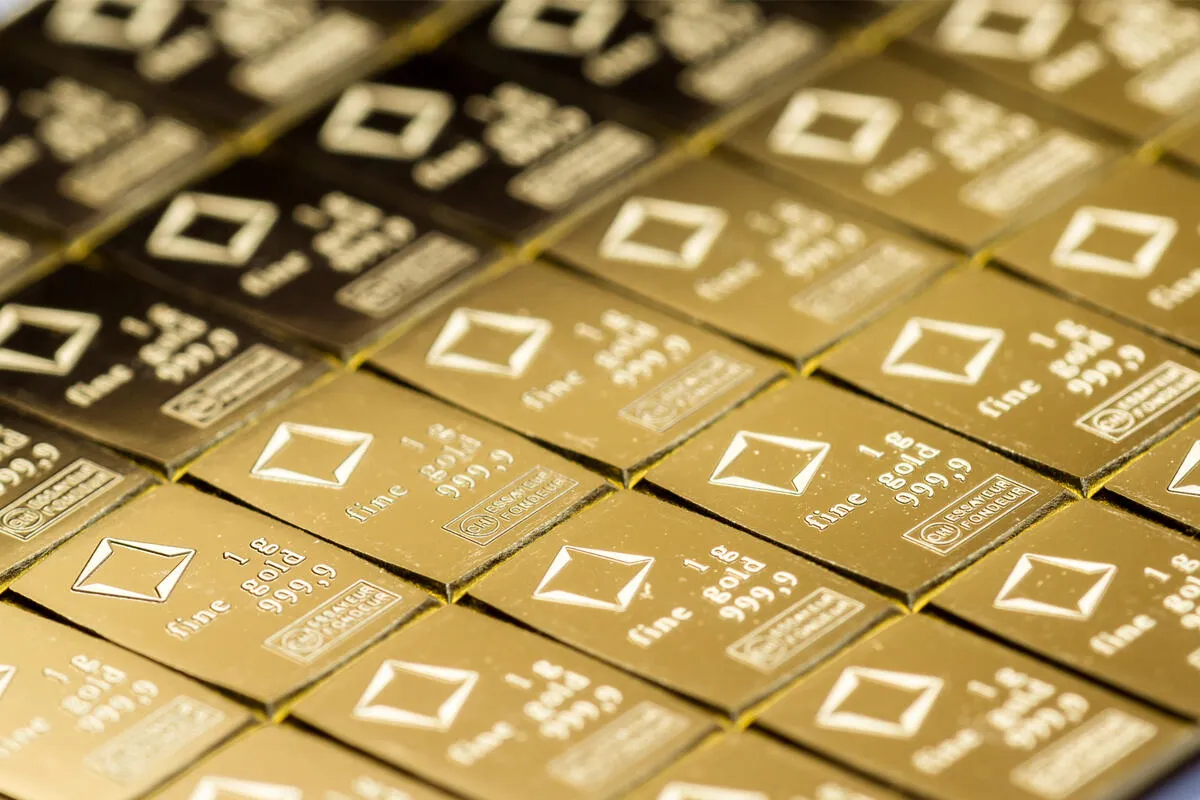

Gold, Silver, Bitcoin Technical Analysis During Economic and Geopolitical Uncertainty

Gold's Response to Economic Signals

Gold is showing a bullish outlook, trading within a descending broadening wedge pattern following recent economic data. Despite a robust rebound, gold struggled to break the $2,663 mark. An important support level lies above the red-dotted trendline, potentially signaling further upside if it breaches $2,685.

Silver's Key Levels and Patterns

- Silver is consolidating near the neckline of the inverted head and shoulders pattern below $32.50.

- A move above this key level could propel silver towards $35.

- The RSI shows bullish momentum, indicating that as long as prices stay above the 50 SMA, the outlook remains positive.

Bitcoin's Bullish Prospects

Bitcoin is also in a prime position with a double bottom formation within a bull flag pattern. A decisive daily close above $72,000 would confirm its breakout and open the door for further gains. Recent strength showcases Bitcoin's resilience in the current market environment.

Market Outlook

As geopolitical tensions and economic uncertainties elevate, the demand for these assets continues to rise. Investors are closely watching retail sales data for cues on future price movements.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.