China Stocks Bull Run: Fiscal Stimulus Hints at Finance Ministry Press Conference

China Stocks Surge Amidst Fiscal Stimulus Speculation

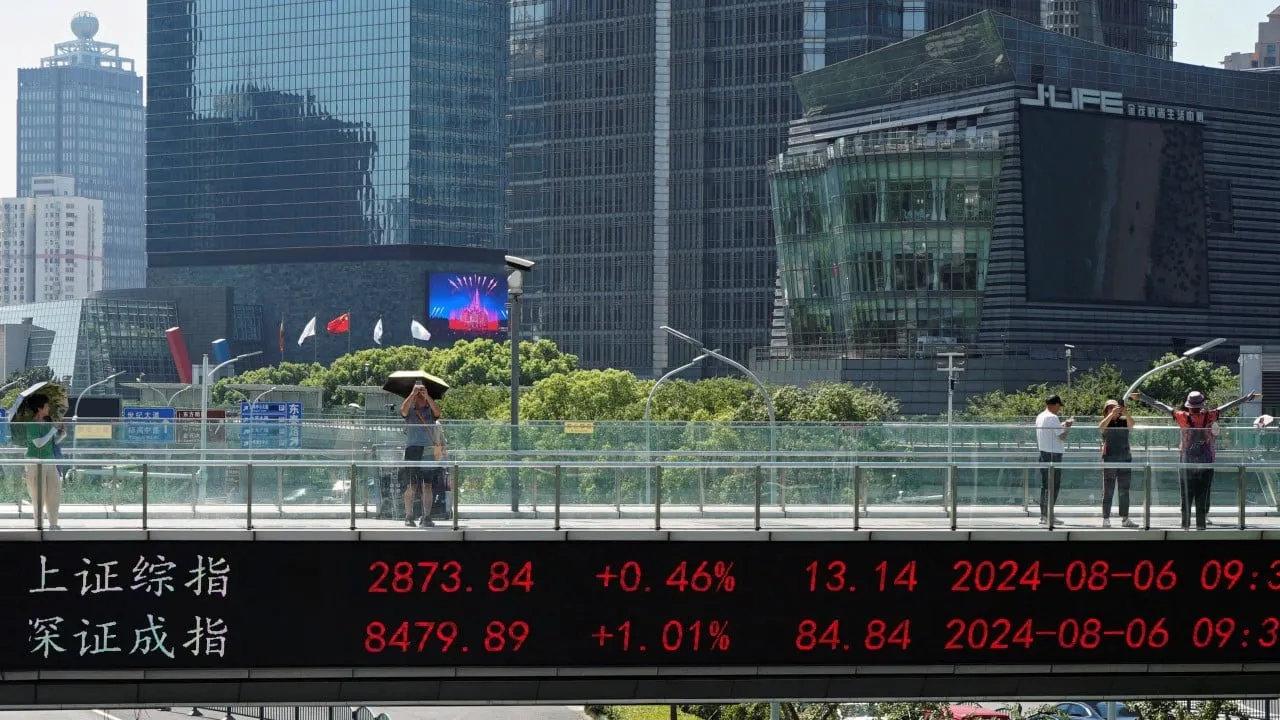

China stocks are on a bull run as investors eagerly anticipate fiscal stimulus following the finance ministry's hints at greater government borrowing. Finance Minister Lan Foan suggested the government might increase budget deficits, fueling hopes for a substantial stimulus package to support the economy.

Impact on the Market: Uncertain but Optimistic

To sustain the current bull run that has added approximately US$4.4 trillion in market value over three weeks, analysts indicate that China would require fiscal stimulus equivalent to 3% of its GDP.

- Nomura Holdings estimates this to be over 3 trillion yuan (US$424 billion).

- Swiss private bank UBP predicts issuance of ultra-long bonds worth 2 trillion yuan.

Investors are driven by optimism since China's CSI 300 Index rose nearly 2% following this anticipation.

Government Measures: The Path Ahead

While the finance ministry refrained from detailing the scale of fiscal support, the debt swap programme and allowances for local governments to issue bonds to stabilize the property market emerged from the news conference.

- Local governments can use bonds to purchase unsold homes.

- Sovereign bonds are set to be issued to support state-owned banks.

This commitment to a higher fiscal deficit aims to stabilize market sentiment amidst recent volatility. Economists anticipate that full details will await the National People’s Congress meeting, expected soon.

Looking Forward: Analyst Predictions

Analysts, including those from Goldman Sachs, advocate bullish sentiments, citing ten reasons to invest in Chinese stocks as a response to the easing monetary policies. They highlight the unprecedented nature of current fiscal measures.

This momentum and expectation of more fiscal measures will likely shape China's economic landscape leading into 2025.

Beyond mere speculation, this suggests a pivotal change for China's regulatory and financial environment, one that investors should watch closely.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.