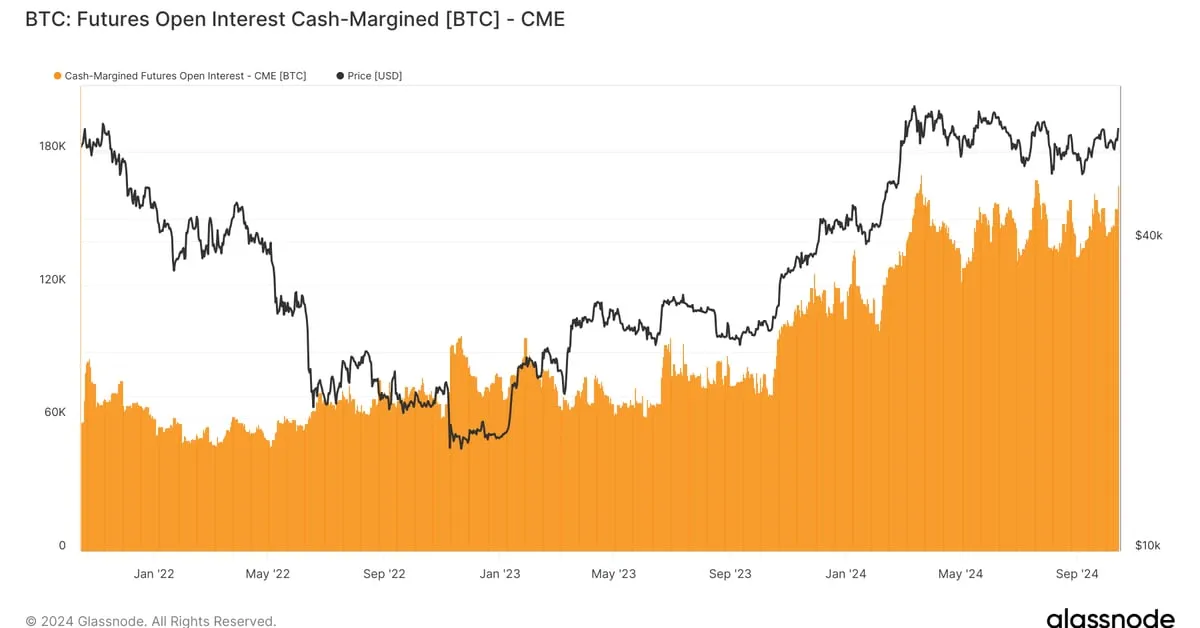

BTC Cash-Margined Futures: CME Open Interest Surpasses All-Time Highs

BTC cash-margined futures are witnessing a dramatic rise in popularity within the financial markets. The CME has reported a record open interest of 384k BTC, amounting to $25.5B, highlighting the growing appetite among investors for Bitcoin derivatives.

Understanding the Surge in Popularity

The increase in open interest signals rising confidence among investors navigating BTC futures, particularly as Binance continues to thrive in the crypto trading landscape.

Factors Contributing to Increased Demand

- Market Liquidity: Enhanced liquidity available through cash-margined futures.

- Investor Confidence: Growing attractiveness of BTC as a financial asset.

- Regulatory Framework: Clearer guidelines fostering increased institutional participation.

Market Implications

This trend holds significant implications for the cryptocurrency market and overall financial strategies moving forward. As demand for BTC remains strong, traders should evaluate CME futures' potential impact on market dynamics.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.