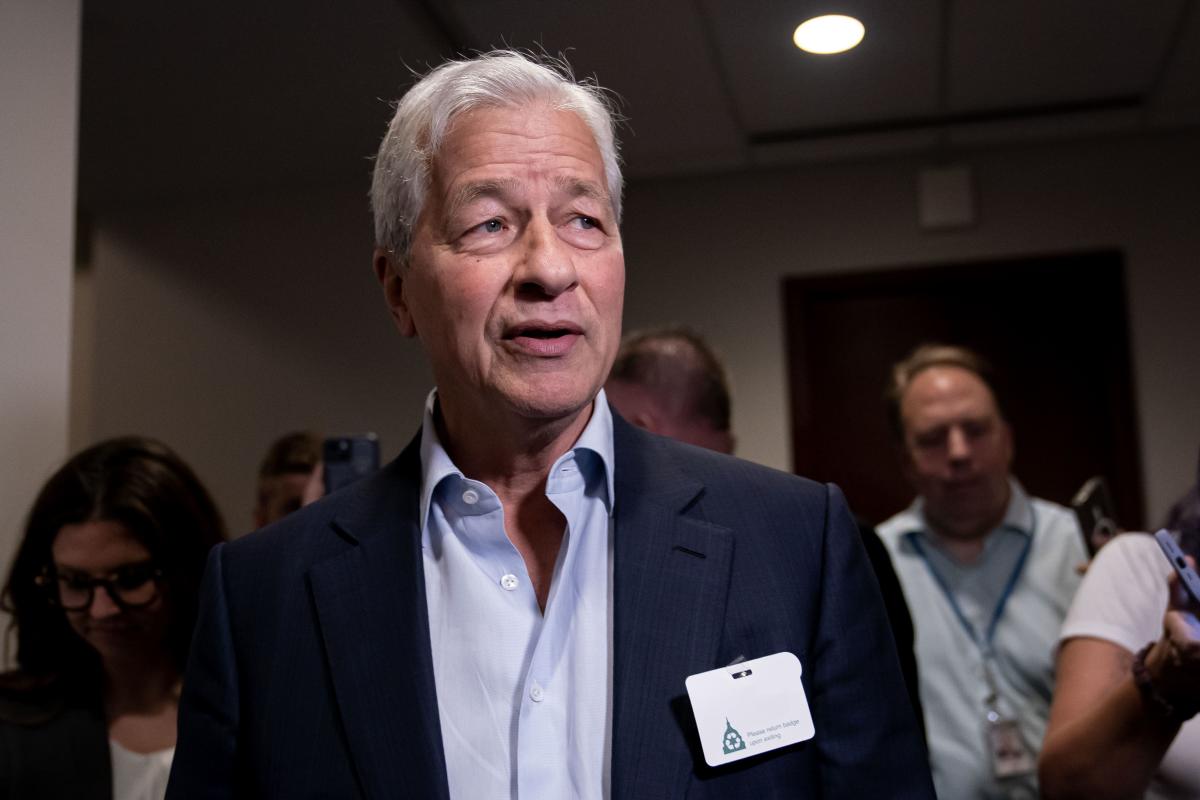

Jamie Dimon: 'There Could Be Hell to Pay' If Private Credit Market Sours

Jamie Dimon's Warning on Private Credit Market

Jamie Dimon, CEO of JPMorgan Chase, has expressed concerns over potential disruptions in the private credit market. He emphasized the importance of monitoring the sector closely to avert possible crises.

Risks for Retail Clients

- Increased Participation: Dimon's remarks shed light on the growing presence of retail clients in the private credit domain, raising concerns about their exposure to risks.

Dimon cautioned that 'there could be hell to pay' if issues arise in the private credit segment, signaling the need for proactive risk management strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.