Breaking News: Politics - Understanding Trump's Proposed Tax Break on Car Loan Interest

Trump's Tax Break Proposal: An Overview

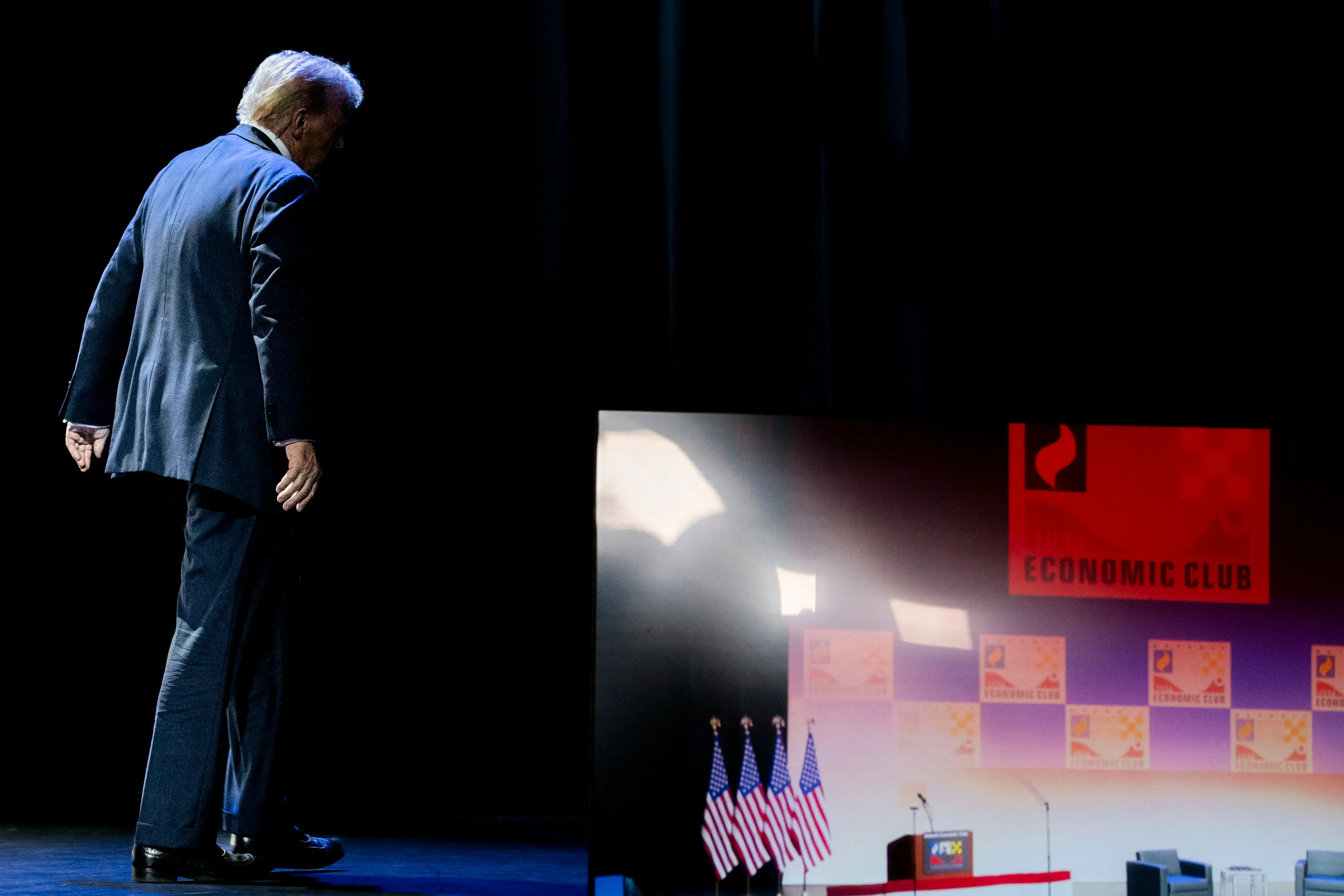

Breaking news surrounding politics involves Donald Trump's recent proposal for a tax deduction on car loan interest. This potential policy change aims to ease financial burdens on taxpayers, particularly those purchasing high-end vehicles.

Target Audience for Tax Deduction

Experts suggest that this proposal mainly benefits wealthier taxpayers who opt for expensive cars. The implications of such policies often widen the financial gap, raising questions about government taxation and its equitable distribution.

Implications for Personal Finance

- Potential Tax Savings for affluent vehicle buyers.

- Impact on Personal Finance decisions regarding vehicle purchases.

- Critique of Wealth Disparities exacerbated by such tax breaks.

Conclusion: Financial Insights Ahead

As this breaking news unfolds, taxpayers must stay informed about how such legislative changes could reshape personal finance and impact overall economic dynamics.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.