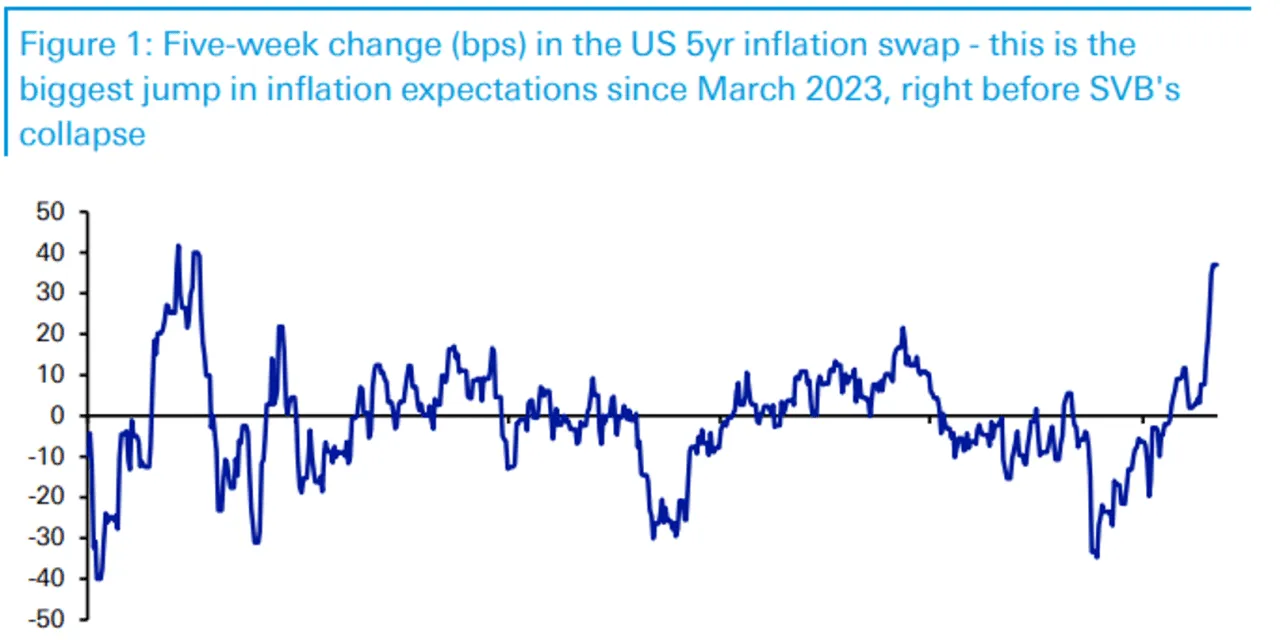

Bond-Market Measures Indicate Significant Increase in Inflation Expectations

Bond-Market Impacts on Inflation Expectations

This bond-market measure shows the biggest jump in inflation expectations since 2023 due to a series of economic developments. Jim Reid, head of global economics at Deutsche Bank, notes that if the economy remains stable, a significant easing cycle could lead to increased inflation rates. The Federal Reserve's decision to cut its benchmark rate by 50 basis points in September has certainly influenced market perspectives on inflation and interest rates.

Geopolitical and Economic Factors

Alongside the Fed's actions, expectations surrounding the European Central Bank's potential easing policies have contributed to the changing inflation outlook. Further complicating the scenario are geopolitical risks and the prospect of a substantial stimulus from China, which could drive up oil and commodity prices. While U.S. economic data remains relatively strong, the confluence of these factors paints a complex picture.

Analyst Insights

This is not to say inflation is out of control, Reid asserts. He stresses that while narratives of a strong economy, an assertive Fed easing cycle, and stable inflation create an optimistic outlook, achieving all three is challenging. The realities of economic conditions will determine the likelihood of these scenarios unfolding.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.