Bitcoin ETF Market Expansion Driven by Liquidity and Options Strategies

Liquidity's Role in Bitcoin ETF Market Expansion

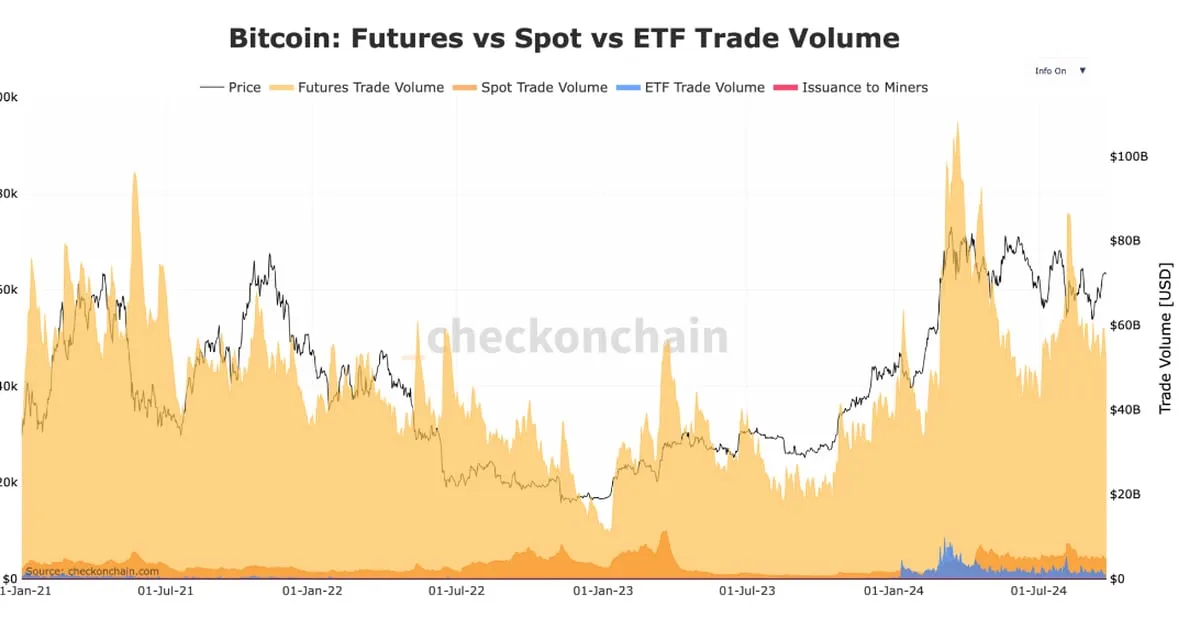

The bitcoin ETF market is experiencing significant growth thanks to increased liquidity. As more capital flows into BTC investments, institutional investors are leveraging their resources to create innovative options strategies.

Options Strategies Influencing the Market

Options trading is emerging as a critical tool for managing risk and enhancing returns in the bitcoin ETF space. By employing various strategies, institutions can navigate market volatility while positioning themselves for potential profits.

- Enhanced Market Efficiency: Increased liquidity fosters a competitive trading environment, leading to improved price discovery.

- Institutional Participation: As more funds enter the market, institutional investors drive higher demand for bitcoin ETFs.

- Risk Management: Options provide institutions with tools to hedge against price fluctuations in BTC.

Future Outlook for Bitcoin ETFs

The future looks promising for bitcoin ETFs, with ongoing interest from both retail and institutional participants. The convergence of liquidity and options strategies could potentially lead to unprecedented growth in this sector, solidifying BTC's place in the global financial landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.