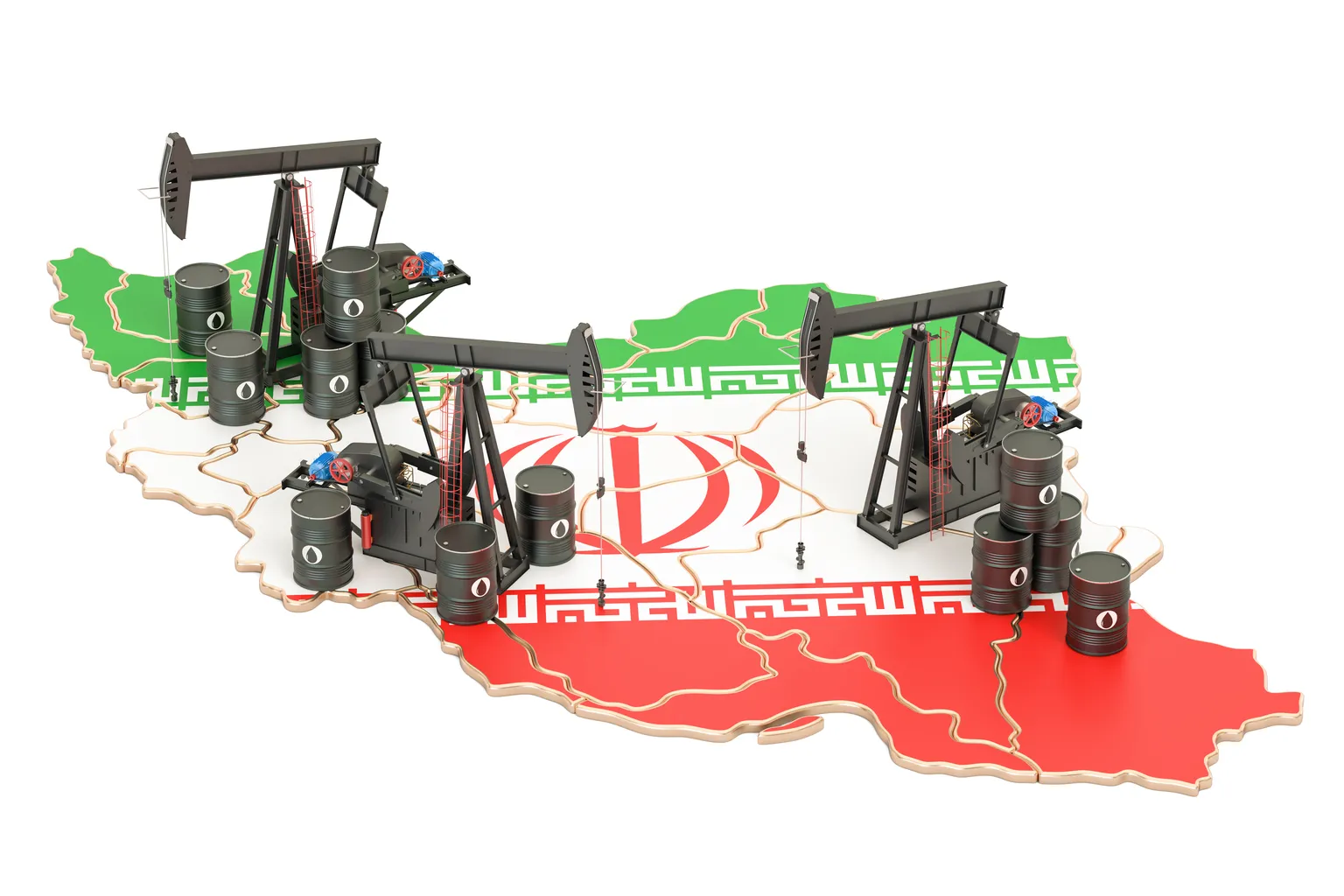

Israel's Potential Strikes on Iranian Military and Energy Sites and Its Oil Supply Implications

Saturday, 12 October 2024, 15:08

Israel's Response to Iranian Aggression

Israel's recent considerations of striking Iranian military and energy targets mark a pivotal moment in Middle Eastern geopolitics. In light of Iran's missile assault, Israel could retaliate, significantly affecting not only regional security but also global oil markets.

Potential Market Disruptions

- Impact on Oil Supplies: Any military action could jeopardize supply routes and lead to spiking oil prices.

- Investment Uncertainties: Investors may face increased volatility and risk in commodities such as oil.

- Geopolitical Ramifications: Broader implications could affect relations with other nations and global economic stability.

Stakeholder Considerations

- Monitored Developments: Stakeholders should stay informed about any military engagements.

- Reflective Strategies: Adjust investments based on the evolving geopolitical landscape.

- Risk Assessment: Prepare for sudden changes in market conditions driven by this conflict.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.