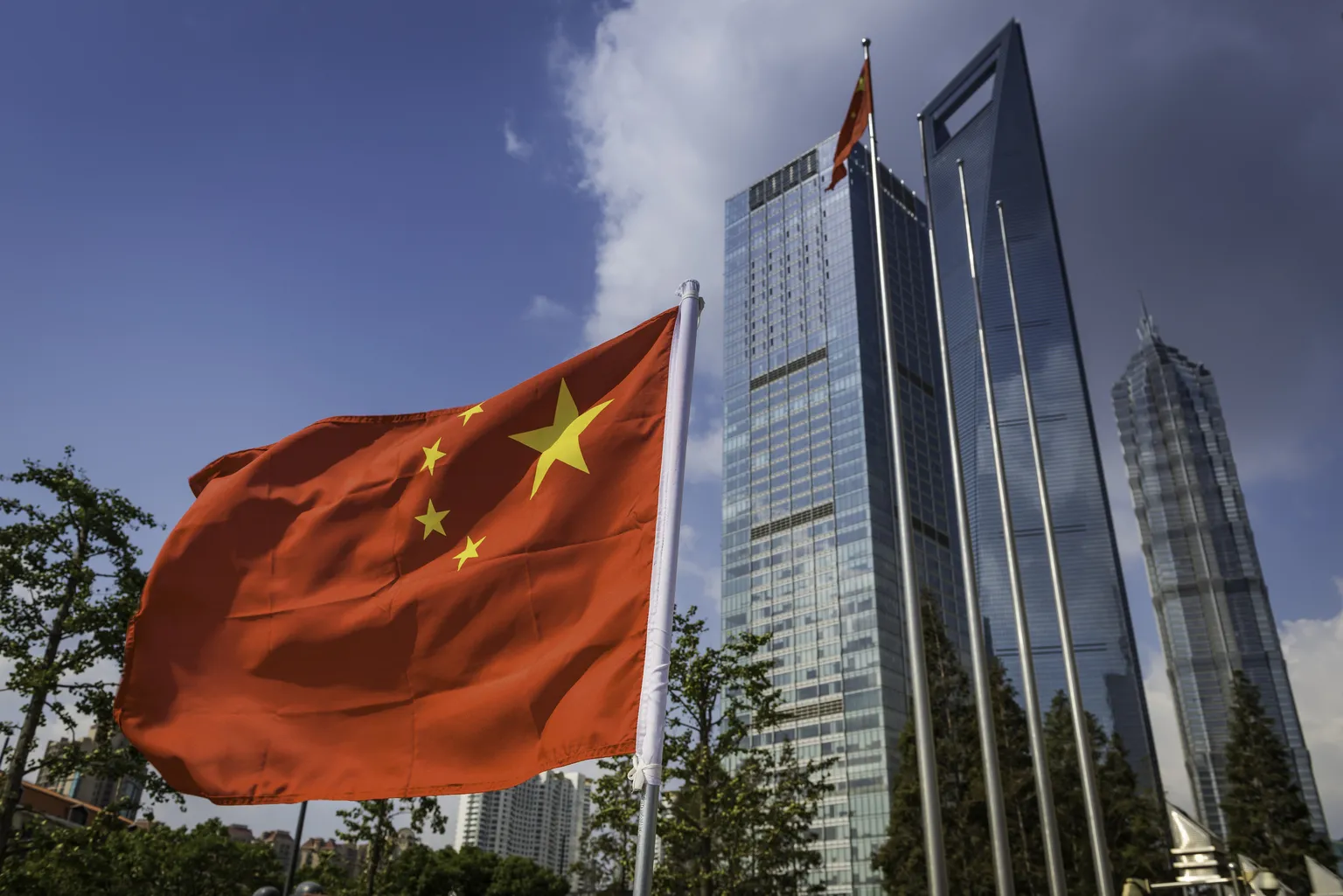

China's Macro Melt-Up: What To Know And How To Trade It

Understanding China's Macro Melt-Up

As the People's Bank of China (PBoC) implements strategic measures, stakeholders witness a notable macro melt-up in the Chinese markets. This shift sparks intrigue among investors aiming to capitalize on these trends.

Trading Strategies in a Volatile Market

Investors keen on maximizing returns should consider selling volatility as an advantageous strategy. This approach could potentially yield significant gains, particularly in the context of fluctuating market conditions.

- Stay informed: Continuously monitor PBoC actions and their implications.

- Diversify strategies: Explore various trading methodologies to mitigate risks.

- Assess market indicators: Regularly evaluate performance indicators to guide decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.