Celestica's Valuation and Future Prospects: A Value Buy? (NYSE:CLS)

Evaluating Celestica's Value Proposition

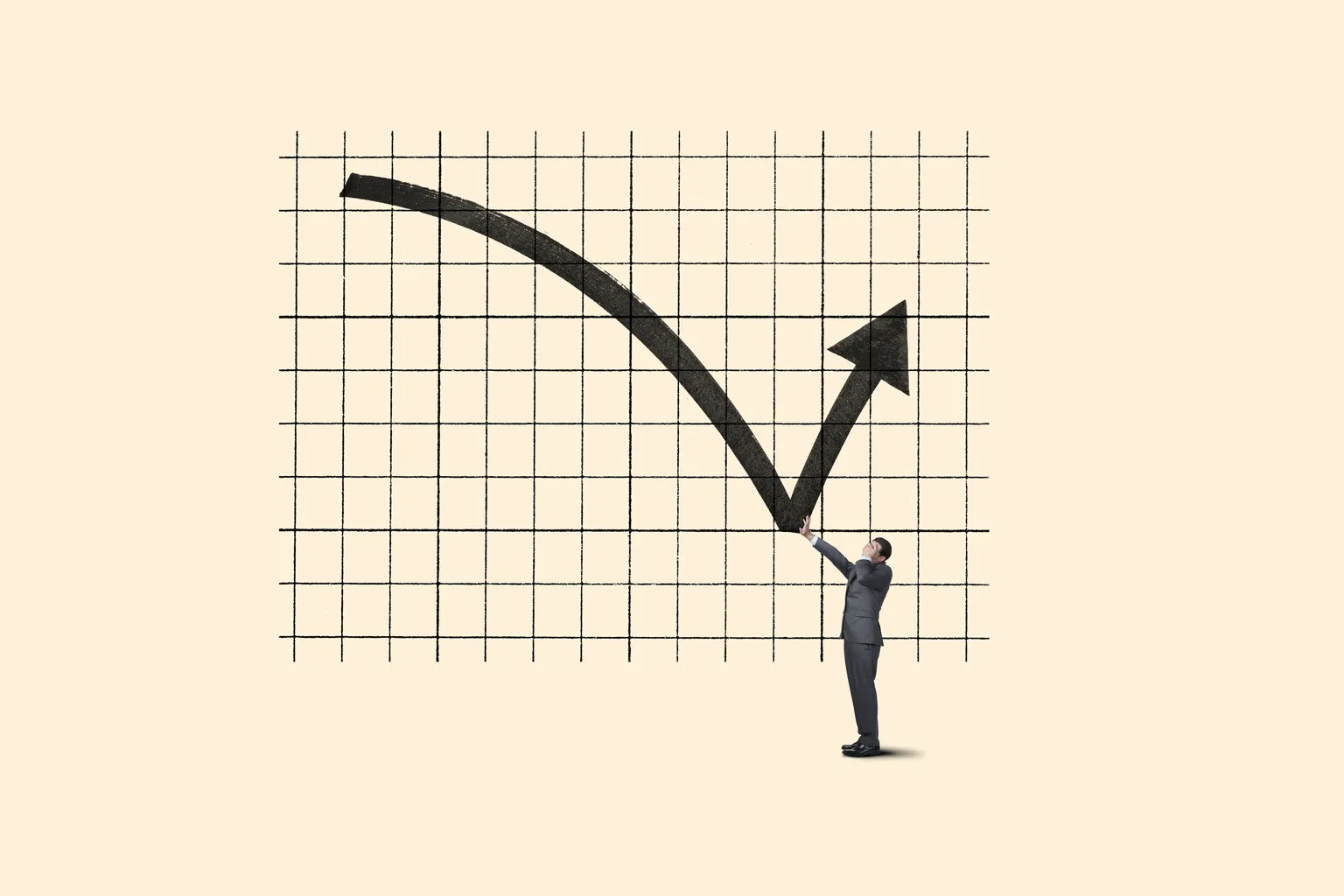

Celestica continues to demonstrate attractive valuation metrics amid a recent recovery in its stock price. Here, we delve into the key performance indicators that highlight why CLS is still considered a value buy in today’s market.

Performance Metrics Overview

- Strong Revenue Growth: Celestica has posted impressive revenue growth over the past quarters, which signals robust operational efficiency.

- Margin Fluctuations: While margins have seen some volatility, the management’s strategies are likely to stabilize them moving forward.

Future Outlook

Looking ahead, investors are advised to exercise caution. The potential challenges for FY2025 could impact Celestica's long-term performance, warranting thorough analysis before making investment decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.