Janus Henderson Stock: Operational Improvements Lead to Increased Beta and Share Value

Operational Enhancements at Janus Henderson

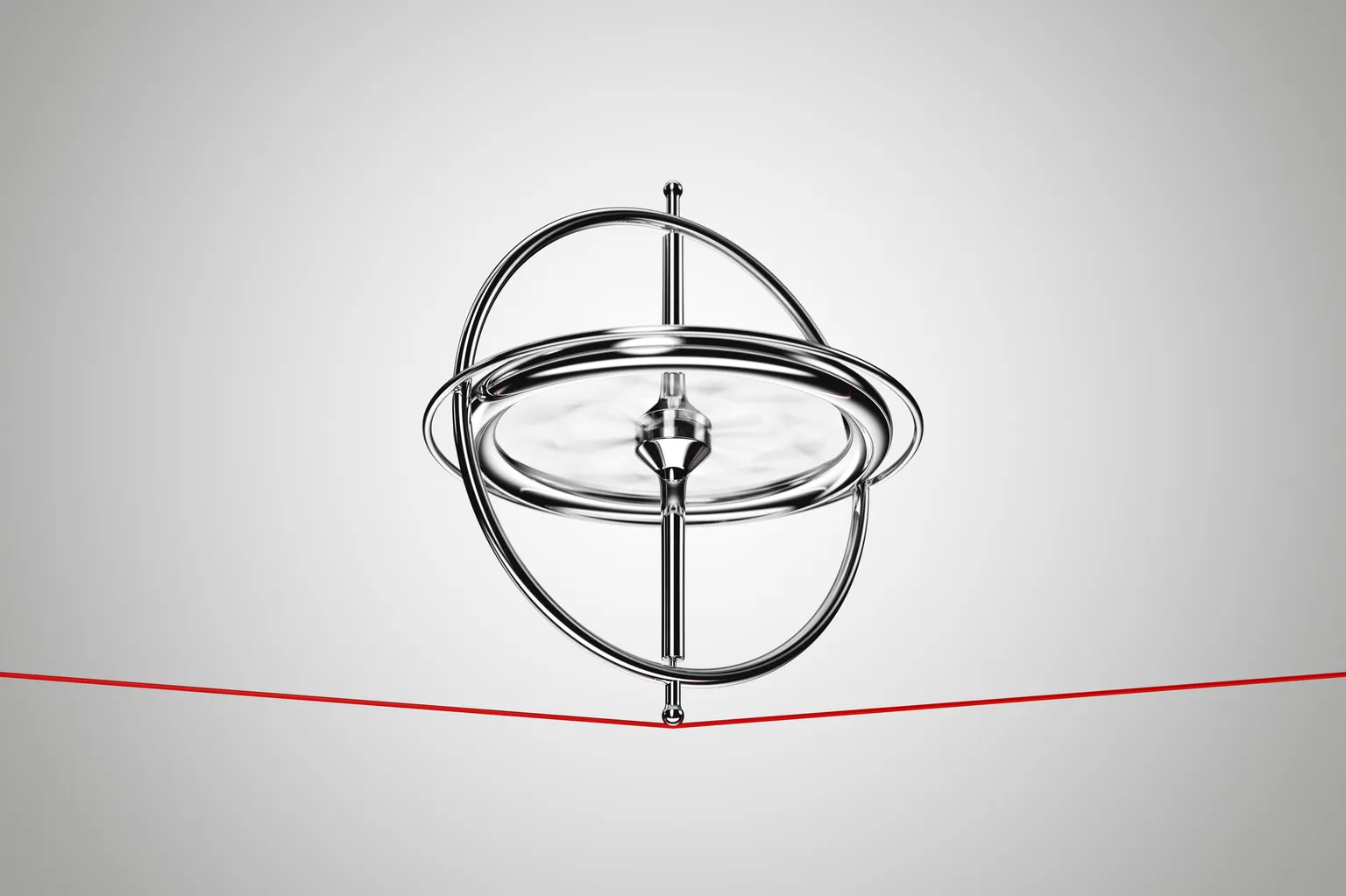

In the latest financial quarter, Janus Henderson has reported significant operational improvements. These enhancements have positively influenced the stock's beta, indicating greater responsiveness to market movements. Investors should take note of this enhanced sensitivity as it may lead to increased volatility.

Assessing Risks

However, potential acquisition risks and ongoing valuation concerns loom large. Investors must weigh the possibilities against these inherent risks. Valuation metrics suggest a need for caution in investment decisions.

- Operational efficiency gains

- Beta sensitivity to market fluctuations

- Valuation scrutiny recommended

Market Outlook and Strategic Considerations

Despite these challenges, the market outlook for Janus Henderson remains cautiously optimistic. Strategic planning and informed risk management will be vital as investors consider positions in light of the evolving landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.