Downgrading Palantir To Hold: Market Realities of PLTR Stock

Market Sentiment and Palantir's Valuation

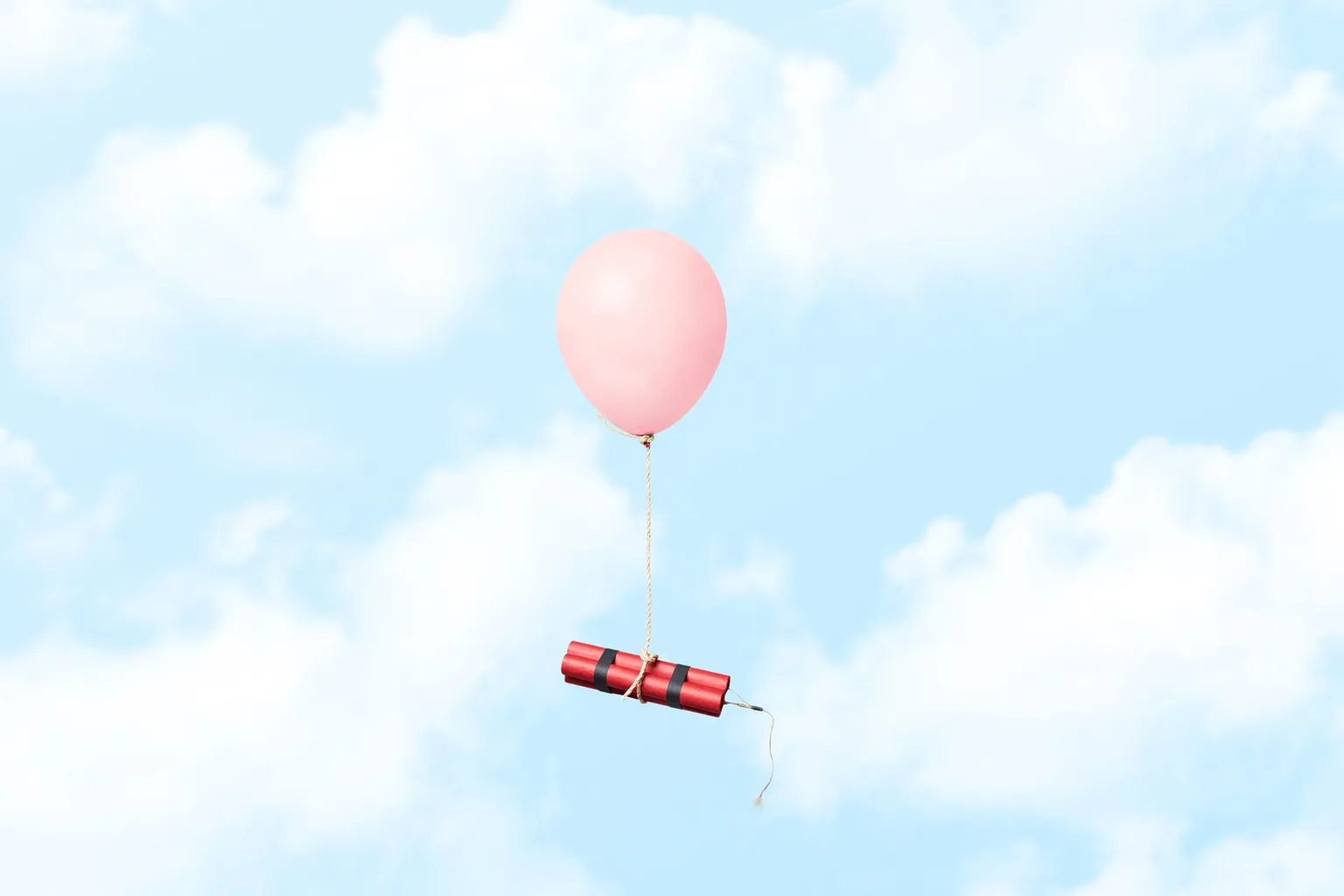

The recent surge in Palantir's stock price has led to a scenario where we see many *positives* already accounted for in its current valuation. Investors need to be cautious as we downgrade Palantir to a Hold status. Reasons include:

- Market Overvaluation: The stock appears to be *overbought*.

- Expectations of Price Correction: A pullback is likely given the rapid ascent.

- Shift in Investor Sentiment: A recalibration of *growth prospects* is underway.

Strategic Implications for Investors

In light of this downgrade, investors must re-evaluate their positions in PLTR. There are several strategies to consider:

- Assess personal investment timelines.

- Decide whether to hold, sell, or buy more stocks based on market conditions.

- Consider diversification to mitigate potential losses.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.