Q3 Investor Letter Insights: What If Rates Align With Yield Curve Averages?

Market Dynamics and Yield Curve Averages

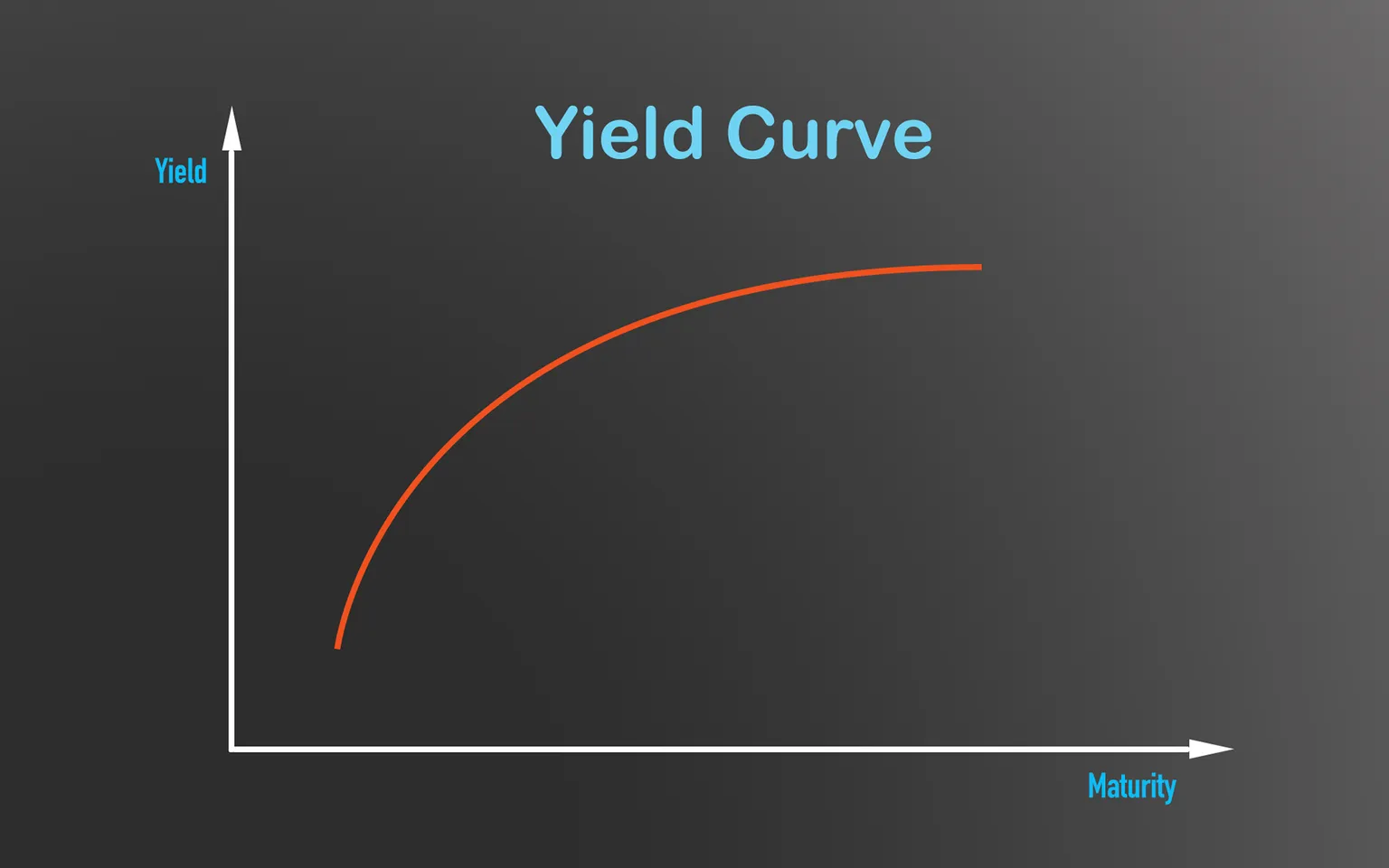

As we evaluate market conditions, we pose an intriguing question: What if rates return to yield curve averages? Such a scenario could dramatically shift investor sentiment and strategies.

Strategic Positioning

- Short-Duration TIPS: These securities offer protection against inflation and could become increasingly valuable.

- Long Position in USD: Holding a robust USD position has shown advantages in previous market fluctuations.

- Under-Weighting in Duration: However, a cautious approach in duration has recently impacted overall returns.

Assessing Future Opportunities

Investors must remain vigilant for potential opportunities that arise from rate shifts, including examining sectors that may outperform in a rising rate environment. Staying adaptive to market signals is key to navigating uncertainties ahead.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.