First-Time Buyers Paying £350 More Per Month on Mortgages, According to DailyMail Money

Insight into Mortgage Trends

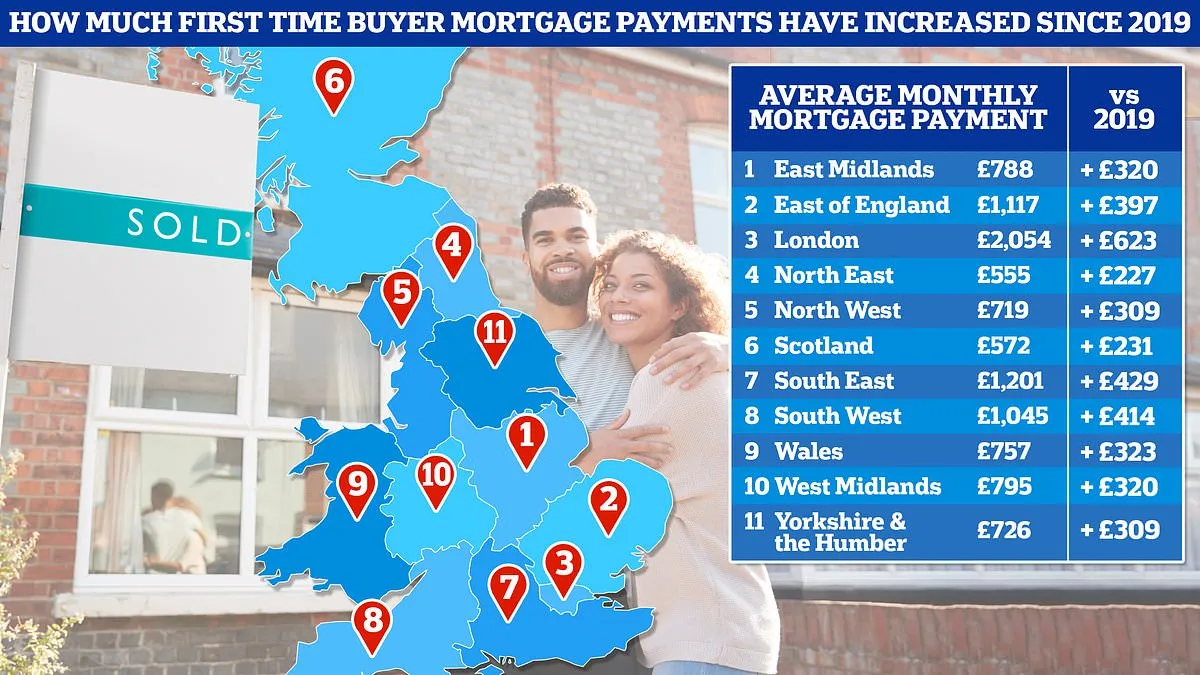

DailyMail Money highlights a critical issue: first-time buyers are facing a staggering increase in their monthly mortgage payments. In fact, buyers today are paying £350 more each month compared to 2019. This significant rise puts immense pressure on new homeowners as they try to enter the market amidst fluctuating rates.

Factors Influencing Mortgage Costs

- Rising Demand: As more people seek to enter the housing market, competition increases.

- Market Conditions: Economic factors continue to influence home loan rates.

- Policy Changes: Government interventions can impact mortgage availability and costs.

What This Means for Future Buyers

For first-time buyers, understanding the implications of these rising costs is crucial. While recent reductions in home loan costs may offer some relief, the overall scenario remains challenging.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.