Understanding the Economic Impact of Trump's Proposed Tariffs

Tariffs and Their Economic Implications

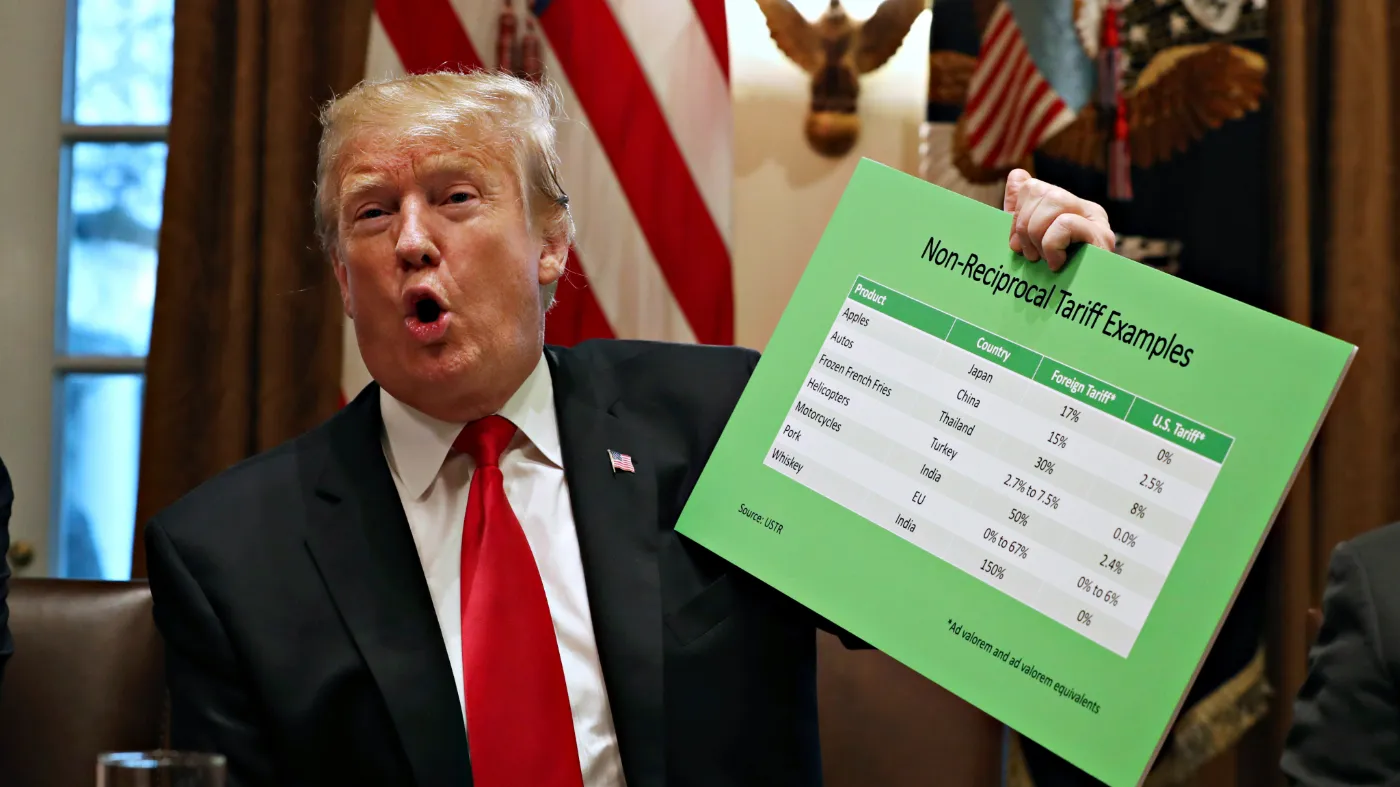

Tariffs, essentially indirect sales taxes, can have broad economic consequences. If President Trump expands tariffs to 20 percent, it will be a historical shift reminiscent of high tariffs from the 19th century. This change will raise prices on essential goods, affecting not only foreign imports but also domestic market prices.

Disproportionate Effects on Different Sectors

While manufacturers that do not export might benefit, the agricultural sector will likely suffer as international markets retaliate. Coastal regions with limited manufacturing will also face challenges, while wealthy individuals will evade much of the tax burden due to their consumption patterns.

The Lobbying Boom

High tariffs will create lucrative opportunities for lobbyists. Companies will seek exemptions and special treatment from tariffs, leading to an intricate system of political favors and deals that echo America's historical reliance on tariffs.

Economic Nationalism and Historical Parallels

Additionally, a surge in tariffs may push the U.S. toward economic nationalism, reminiscent of the 1930s. As countries prioritize self-interest, the global free-trade system could revert to more isolationist policies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.