Goldman Sachs Predicts up to 108% Rally for These 2 ‘Strong Buy’ Stocks

Understanding the Market Dynamics

Given the recent surge in the S&P 500 beyond 5,300, surpassing several experts' year-end targets, it is natural for investors to ponder the market's future direction. Despite the significant rally, Goldman Sachs' chief US equity strategist, David Kostin, opines that there might be limited room for further growth this year. According to Kostin, the current landscape of elevated stock valuations, coupled with modest 2024 GDP and earnings growth forecasts, suggests potential constraints on stock market gains.

Market Insights from David Kostin

Kostin notes, "As the market hovers around the current level, we foresee it trading within a similar, if not lower, range as we approach the end of the year." This perspective doesn't entirely eliminate investor optimism; rather, it invites a more strategic approach.

Despite a flat forecast, Goldman Sachs analysts have pinpointed two robust stocks within their 'strong buy' recommendations, positioning them as potential high-return investments. One of these stocks has the potential to deliver an impressive 108% return in the coming year.

Stock Spotlight: Fulcrum Therapeutics

Fulcrum Therapeutics, a noted player in biopharmaceutical research, is dedicated to developing new therapies for genetically defined diseases with severe symptoms and unmet medical needs. The company's innovative approach revolves around understanding the genetic foundations of diseases, applying their proprietary FulcrumSeek platform to identify drug candidate targets for gene expression modulation.

Breakthroughs in Fulcrum's Pipeline

Fulcrum's two main drug candidates, losmapimod and pociredir, are currently in various stages of clinical development.

The Advancement of Losmapimod

Losmapimod, under investigation for treating facioscapulohumeral muscular dystrophy (FSHD), is in the Phase 3 REACH trial, showing continued advancement with 260 patients enrolled in North America and Europe. The early data from Phase 2 trials indicated significant improvements in functional, structural, and patient-reported outcomes.

Strategic Partnership and Clinical Progress

In a strategic collaboration, Fulcrum recently signed an agreement with Sanofi for losmapimod's further development and commercialization. This deal sees Sanofi paying $80 million upfront, with additional payments dependent on regulatory and sales milestones, alongside royalties. Both companies will share the global development costs equally.

Evaluating Pociredir's Potential

The second candidate, pociredir, shows promise as a treatment for hemoglobinopathies, including sickle cell disease (SCD). Currently in Phase 1b clinical trials, pociredir's progression includes various dosing cohorts to assess its efficacy comprehensively.

Analyst Insights

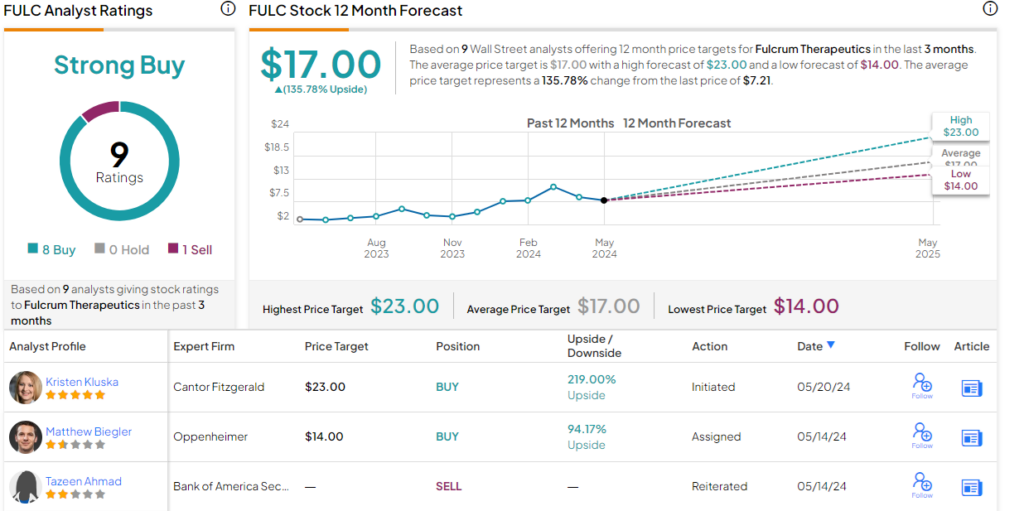

Goldman analyst Corinne Johnson expresses optimism, particularly in the losmapimod development, highlighting its positive clinical data and potential for robust patient uptake. Johnson's target of a $15 share price underlines a 108% upside potential.

Stock Spotlight: Marex Group

Marex Group exemplifies a diversified financial services company, offering market access, liquidity, and infrastructure services globally. With over 4,000 customers, including commodity producers and financial institutions, Marex operates primarily in Europe and the US, with expansion efforts in the Middle East and Asia-Pacific.

Operational Framework and Revenue Streams

Marex’s operations span multiple segments - Clearing, Agency & Execution, Market Making, Solutions, and Corporate. Their Agency & Execution segment, being the largest, contributes to 46% of their revenue, primarily providing liquidity and matching buyers and sellers across various securities markets. The Clearing segment follows, generating 28% of their revenues.

IPO and Financial Highlights

Marex went public in April, offering shares at $19 each, raising approximately $292 million. Their 2023 financial results indicated a significant jump in revenue to $1.245 billion, a 75% increase year-over-year, with a before-tax profit of $197 million.

Analyst Insights

Goldman’s analyst Alexander Blostein holds a bullish view on Marex, citing potential EPS growth averaging 20% through 2026 due to healthy industry volumes, market share gains, and expanding margins. Blostein’s $33 price target reflects a 61% upside potential, affirming Marex’s strong buy consensus rating.

Conclusion

Goldman Sachs’ endorsements highlight Fulcrum Therapeutics and Marex Group as promising 'strong buy' stocks. These companies exemplify innovation and strategic growth potential, making them attractive options for investors aiming for significant returns.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.

FAQ

What are the stocks Goldman Sachs predicts will rally?

Goldman Sachs has identified Fulcrum Therapeutics and Marex Group as 'strong buy' stocks that may rally up to 108%.

What is Fulcrum Therapeutics focusing on?

Fulcrum Therapeutics is focused on developing therapeutic agents for genetically defined diseases using their proprietary FulcrumSeek platform.

What is the potential return Goldman Sachs predicts for Fulcrum Therapeutics?

Analysts predict a potential upside of approximately 108% for Fulcrum Therapeutics.

How is Marex Group positioned in the financial services market?

Marex Group provides market access, liquidity, and infrastructure services globally with a diverse client base and expanding into new geographical markets.

What financial performance did Marex Group achieve in 2023?

Marex Group reported a 75% increase in revenue to $1.245 billion and a before-tax profit of $197 million for 2023.