Is Lam Research's Stock a Buy with $10 Billion Buyback and Stock Split Ahead?

Why did investors turn bullish on Lam?

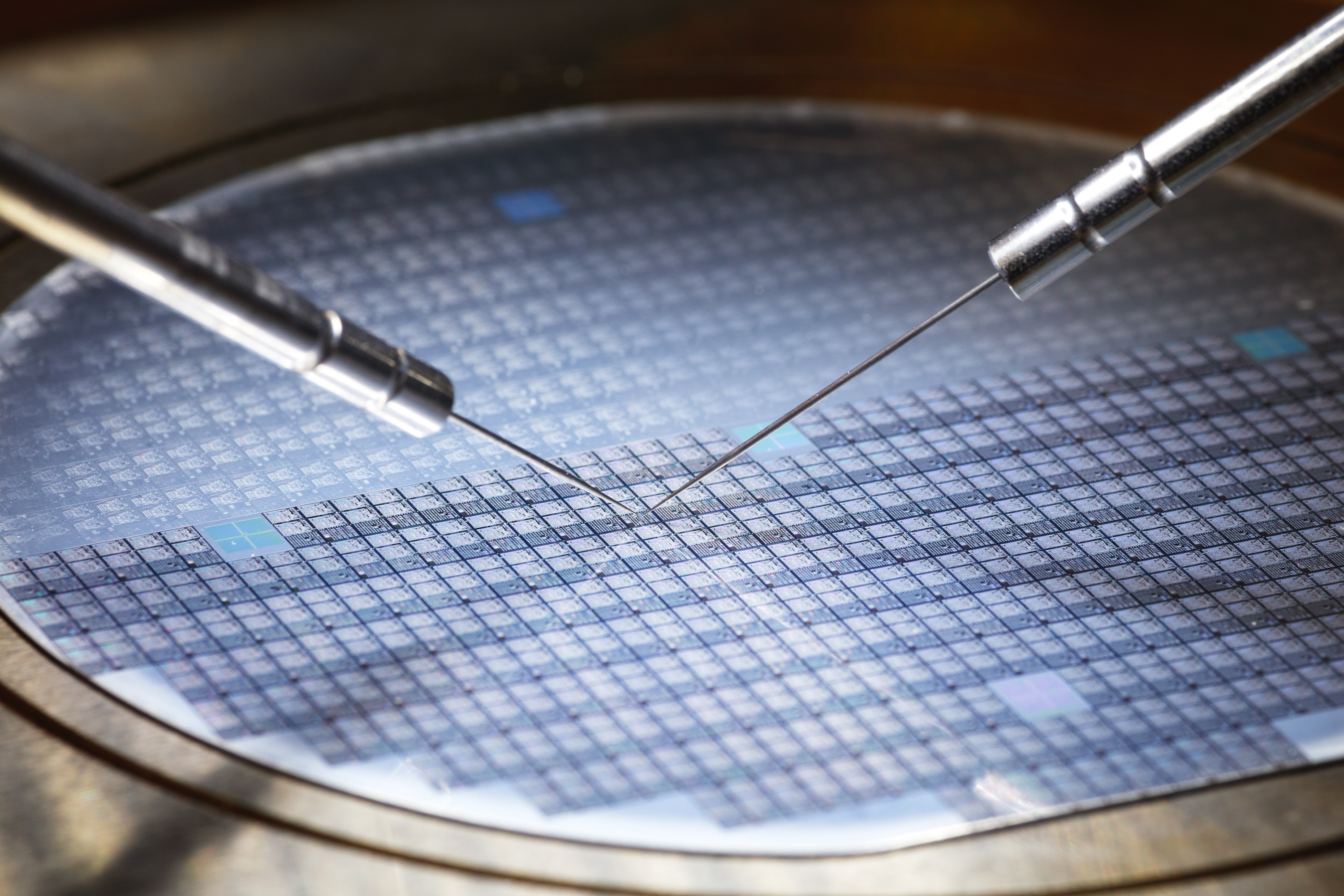

Lam Research, a key player in the semiconductor industry, is positioning itself for growth despite recent market challenges. Its upcoming stock split and robust buyback plan signal confidence in future prospects.

Lam's Growth and Challenges

- In fiscal 2023, revenue and EPS growth was moderate, but the company faces headwinds such as declining PC shipments and geopolitical tensions.

- Despite expected declines in fiscal 2024, Lam is showing signs of recovery with improving margins and sequential growth in revenue and earnings.

Conclusion: While Lam's stock split and buyback may appeal to investors, its valuation, ongoing challenges, and future growth prospects should be considered before making an investment decision.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.