Impact of Inflation Reports and Elections on Treasury Market Volatility

The Rise of Treasury Market Volatility

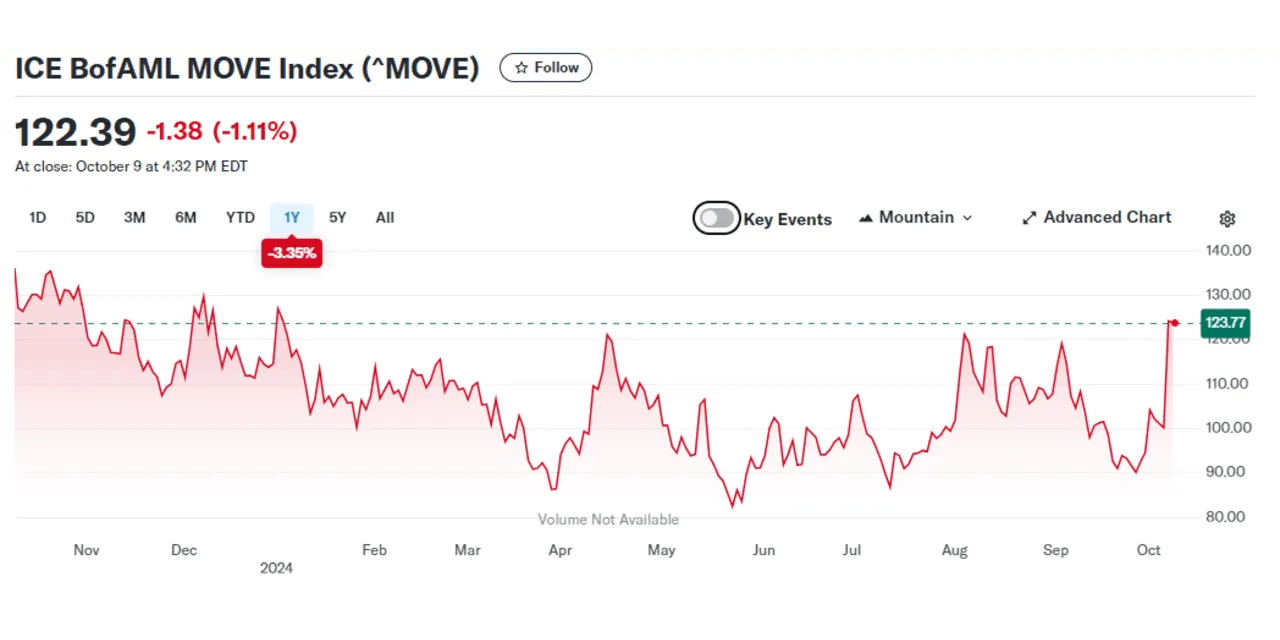

Nervousness in the Treasury market has been building ahead of Thursday's consumer price index inflation report. That's according to the ICE Bank of America MOVE index, which measures the implied volatility of a constant one-month U.S. government bond option. This index serves as a barometer of investor anxiety, akin to a VIX for fixed income, and tends to rise when Treasury investors become increasingly worried.

The MOVE has dipped slightly today but has experienced a significant jump of more than 20% this week, marking its highest level since the start of the year. This spike may not solely be attributed to the impending inflation report, as suggested by Harley Bassman, managing partner at Simplify Asset Management and inventor of the MOVE.

Election Factors Influencing Market Reactions

Bassman points out that anxiety over the approaching election day on November 5 has likely contributed to the surge in the MOVE index. In a message shared on X, he noted that the election has fallen within the MOVE's 30-day observation window. Currently, the MOVE suggests that the market is bracing for significant movements.

- Election Timing: Concerns over the election race add an extra layer of uncertainty in the market.

- Investor Sentiment: Increased volatility reflects a broader apprehension among investors regarding economic indicators.

- Market Adjustments: As these dynamics unfold, investors will need to consider their strategies carefully.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.