Why VanEck Semiconductor ETF Surpasses Invesco QQQ in Tech Sector Performance

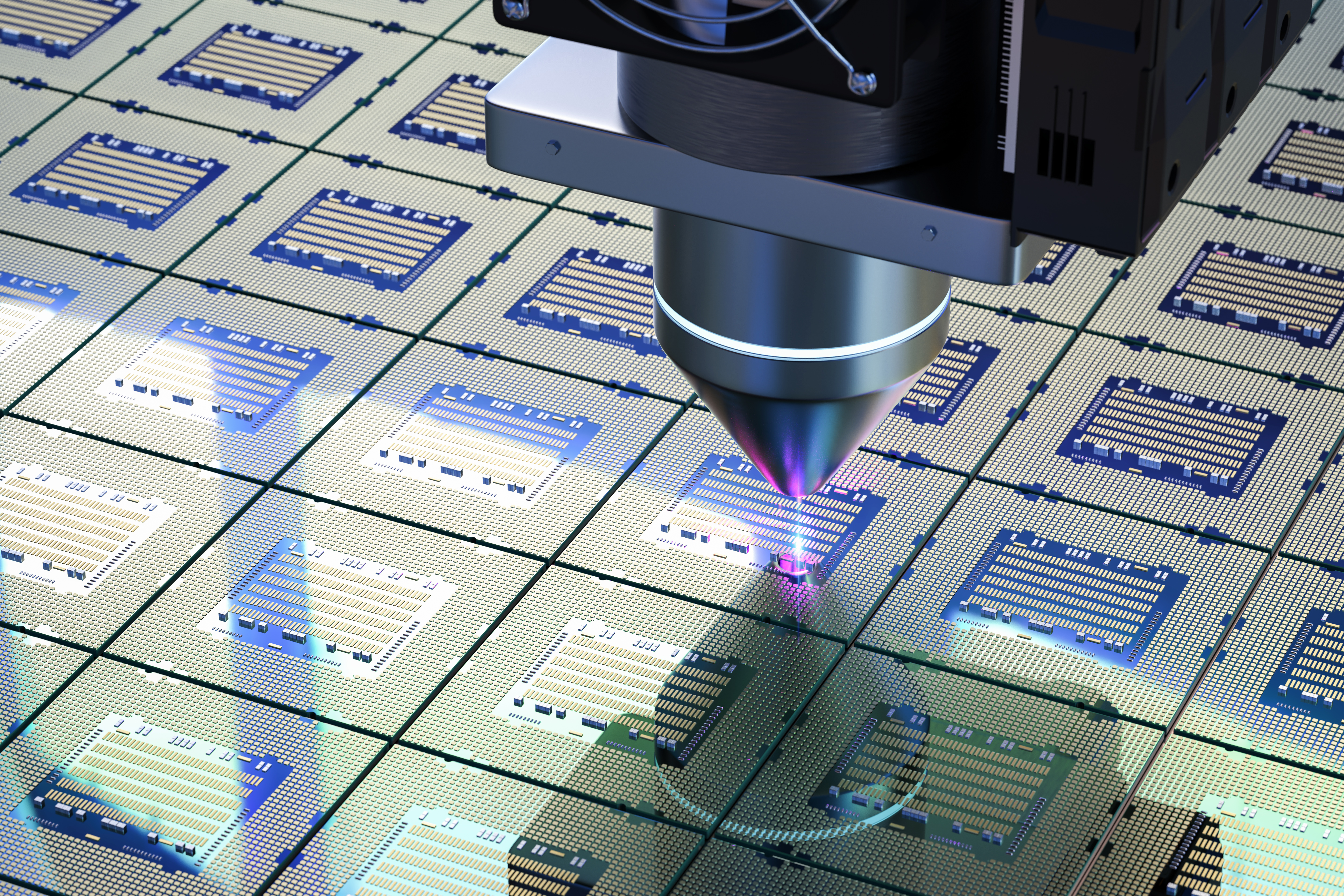

The semiconductor ETF

One specific segment within tech has consistently outperformed most others. At first glance, it may seem unwise to speak negatively of the Nasdaq 100 and its corresponding exchange-traded fund (ETF), the Invesco QQQ Trust (NASDAQ: QQQ). Considering that $100,000 invested 20 years ago is now worth about $1.3 million, it has obviously served as an excellent investment vehicle.

However, one segment of tech has stood out for its performance: semiconductors. Despite a relatively high level of volatility, chips have powered the tech industry, taking tech returns considerably higher. Thus, instead of investing in the Nasdaq 100 through the Invesco QQQ Trust, one might want to consider a certain semiconductor ETF that may bring higher returns.

The VanEck Semiconductor ETF

Admittedly, the VanEck ETF comes with a higher level of risk. With that fund, investors are all-in, not only on technology, but also on a specific part of the tech industry. Also, instead of 100 stocks, the VanEck fund holds only 26 stocks.

- In comparison, the Nasdaq 100 has a 59% allocation to technology as of the end of the first quarter of 2024. Still, that index holds stakes in 10 industry sectors, a factor that brings some diversification.

- Also, VanEck ETF shareholders pay an expense ratio of 0.35%, higher than that of Invesco QQQ at 0.20%.

Moreover, a part of the higher returns may ironically be the cyclicality within the semiconductor industry. As much as investors benefit from significant upside in the chip industry, it is also known for considerable sell-offs during downtimes. So severe are the sell-offs that occasionally, the Nasdaq 100 will outperform the VanEck fund.

The VanEck ETF's stock investments

Not surprisingly, its largest position is Nvidia, making up nearly 21% of the fund's holdings. Nvidia currently dominates the market for artificial intelligence (AI) chips, allowing it to post triple-digit revenue growth in recent quarters. That has likely driven a significant amount of its returns this year.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.