Mergers and Acquisitions in Banking and Finance During the 2024 Presidential Election

Understanding Mergers and Acquisitions in the Context of US Politics

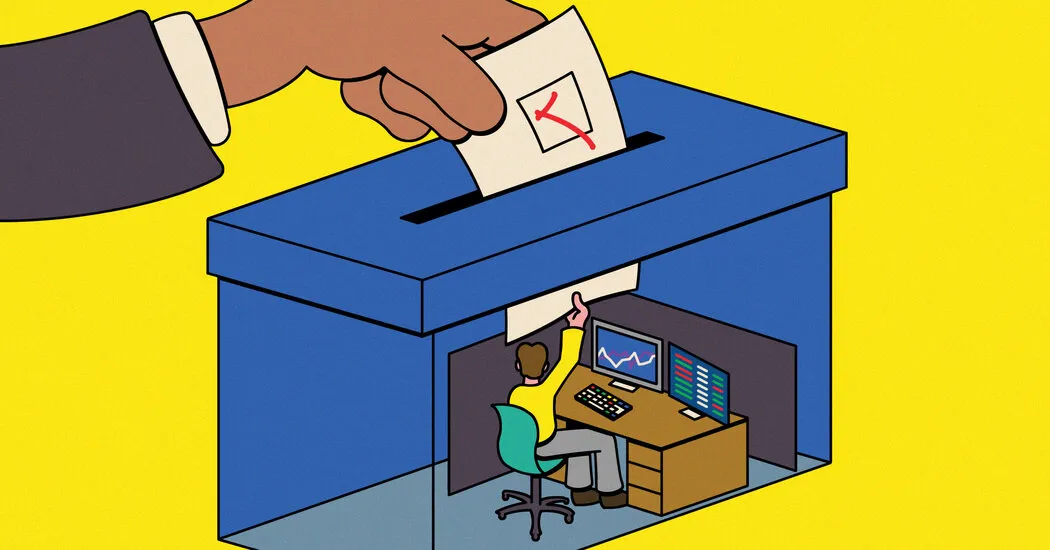

Mergers and acquisitions play a pivotal role in the banking and finance sector, and the 2024 presidential election introduces uncertainties that could shift investment strategies. Political candidates are making promises that could directly affect regulation and deregulation.

Potential Impact on Competition Law

Increased scrutiny on competition law during election cycles could reshape how companies engage in mergers and acquisitions. Investors are closely monitoring candidate positions on key economic issues.

- Election outcomes may affect capital flow.

- Changes in policy could lead to unexpected shifts in stock valuations.

- Regulatory adjustments may prompt a surge or decline in M&A activity.

The Broader Economic Context

As the US economy responds to the evolving political atmosphere, companies must prepare for a range of future scenarios. Understanding market forecasts in light of the elections is crucial.

- Evaluate potential candidates' economic proposals.

- Track changes in public opinion that might influence stock and bond markets.

- Consider how political dynamics will shape competitive advantages.

Investors must adapt to this volatile environment as we approach a critical moment in US democracy, where every vote counts and every policy promise matters.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.