Macy’s (M) Progress Update: Bold New Chapter and Q1 2024 Results

Tough macro climate

As mentioned on its quarterly conference call, Macy’s customers across all nameplates are benefiting from strong wage and job growth but persistent inflationary pressures are weighing on them.

For this reason, the company believes its customers will continue to remain cautious with regards to their discretionary spending.

Bold New Chapter

Macy’s Bold New Chapter strategy has three pillars – strengthen the Macy’s nameplate, accelerate luxury growth, and simplify and modernize end-to-end operations.

On its call, the company said that it is on or ahead of plan across all three pillars.

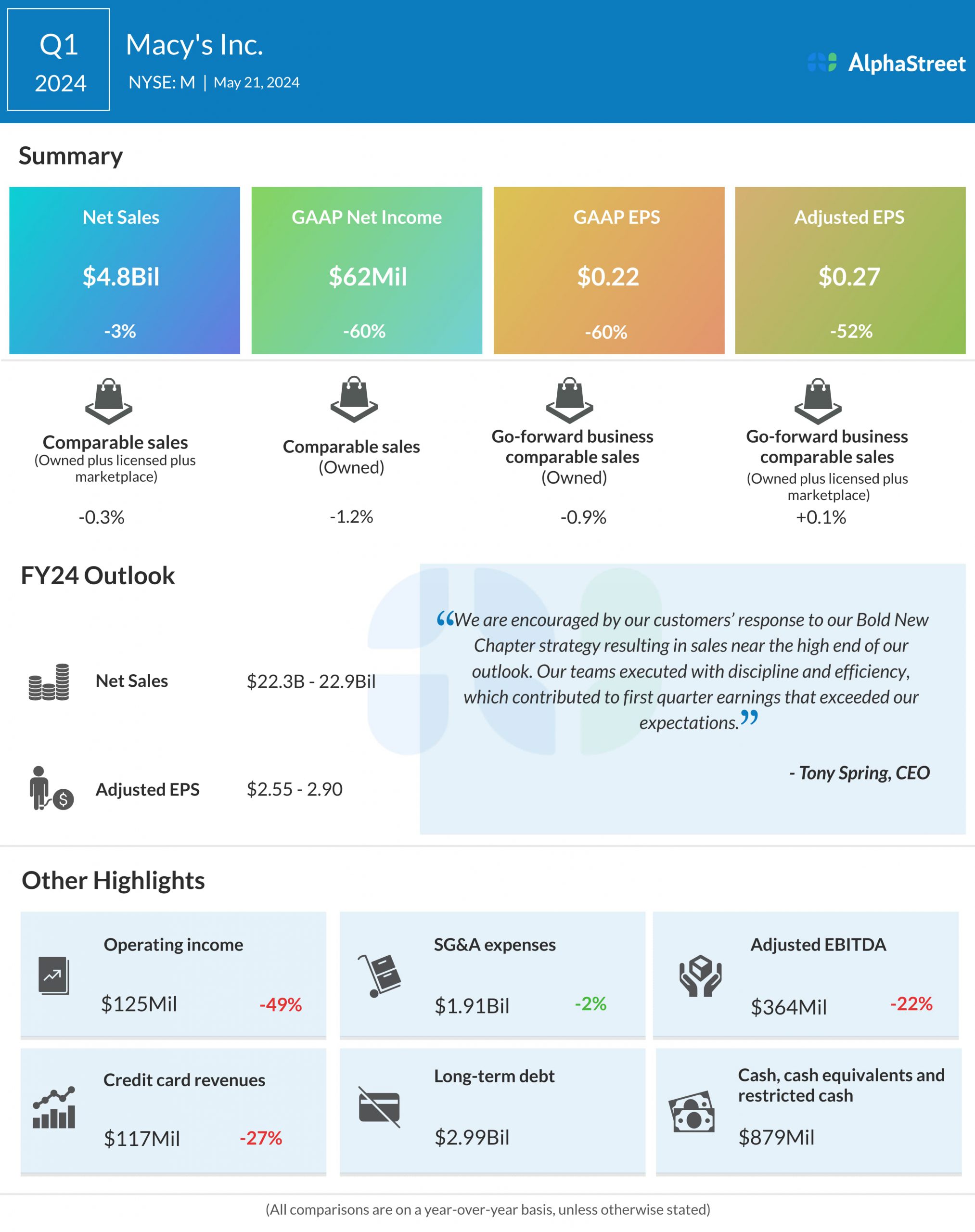

Macy's Q1 2024 Earnings Infographic

Private brand apparel initiative

- Macy’s net sales decreased 2.7% YoY to $4.85 billion

- Adjusted EPS declined 52% to $0.27

- Outlook: Macy’s expects net sales in the range of $4.97-$5.1 billion for Q2 2024

The company has been gaining a positive response to its omnichannel initiatives at the Macy’s nameplate. In addition, full price and planned promotional sell-throughs of new and expanded assortments have been strong.

Outlook

- For the second quarter of 2024, Macy’s expects net sales in the range of $4.97 billion to $5.1 billion. Adjusted EPS is expected to be $0.25-0.33.

- For the full year of 2024, net sales are projected to be $22.3-22.9 billion and adjusted EPS is expected to be $2.55-2.90.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.