RBI Monetary Policy Meeting: Current Stance and Future Directions

RBI Monetary Policy Today

The RBI's latest monetary policy meeting captures the attention of analysts and investors alike. Expectations soar that the RBI will maintain the repo rate at 6.5%, marking ten consecutive meetings without alteration. However, the landscape may shift as economists anticipate a possible change in policy stance in the coming months.

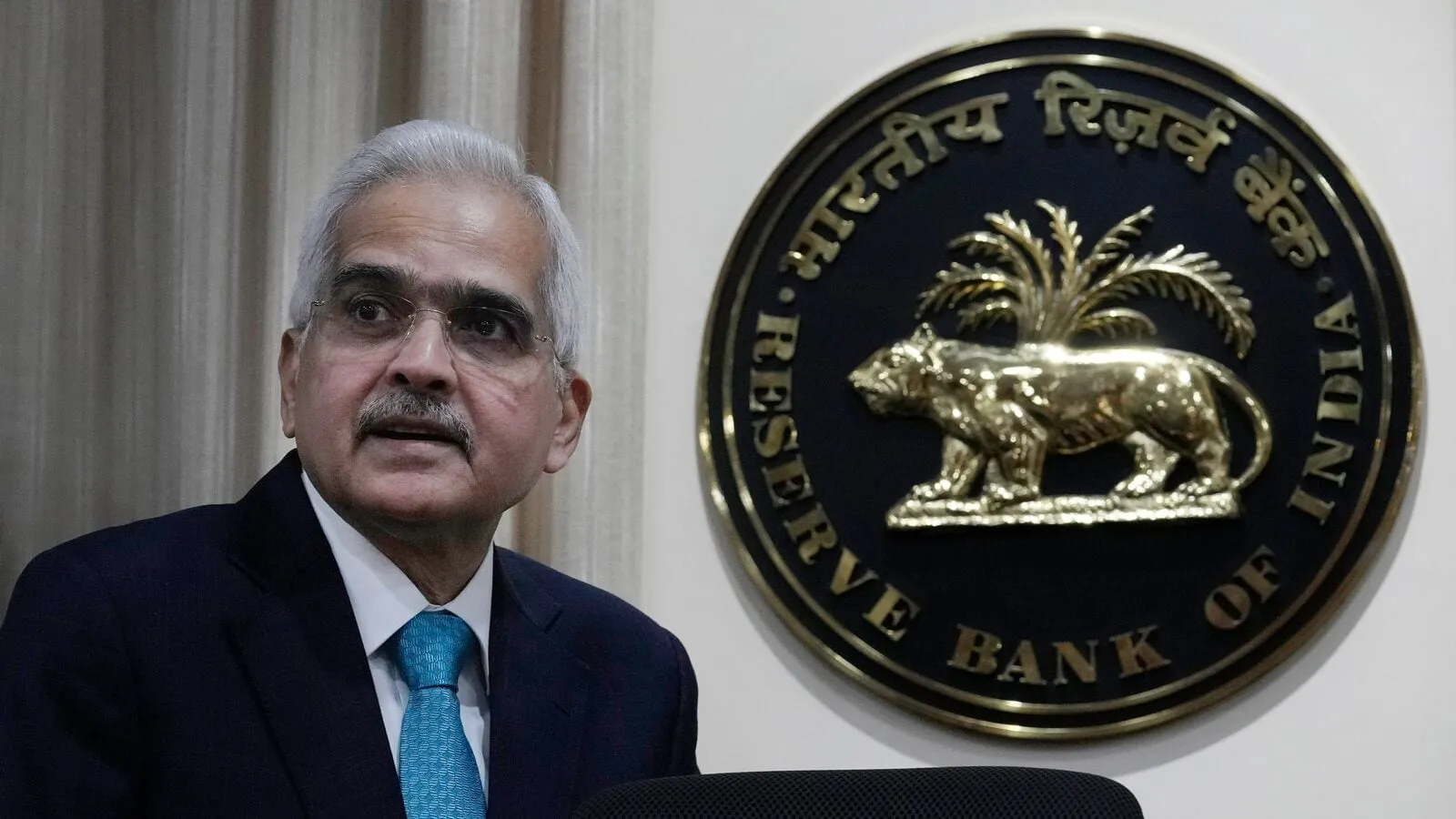

The Role of the RBI Governor

Shaktikanta Das, the RBI Governor, plays a vital role in shaping these decisions. His insights during the RBI monetary policy meetings are critical for understanding future market dynamics.

Market Expectations and Rate Cut Speculations

- Current RBI Repo Rate: 6.5%

- Considerations for Policy Stance Change

- Impact on economic recovery and inflation control

Reactions to Monetary Policy Outcomes

Market participants remain vigilant as they await the RBI policy outcome. Analysts suggest that reductions in interest rates could stimulate economic growth, especially if inflation metrics signal an opportunity for easing.

For more detailed insights, visit the source for further information on RBI's monetary policy decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.