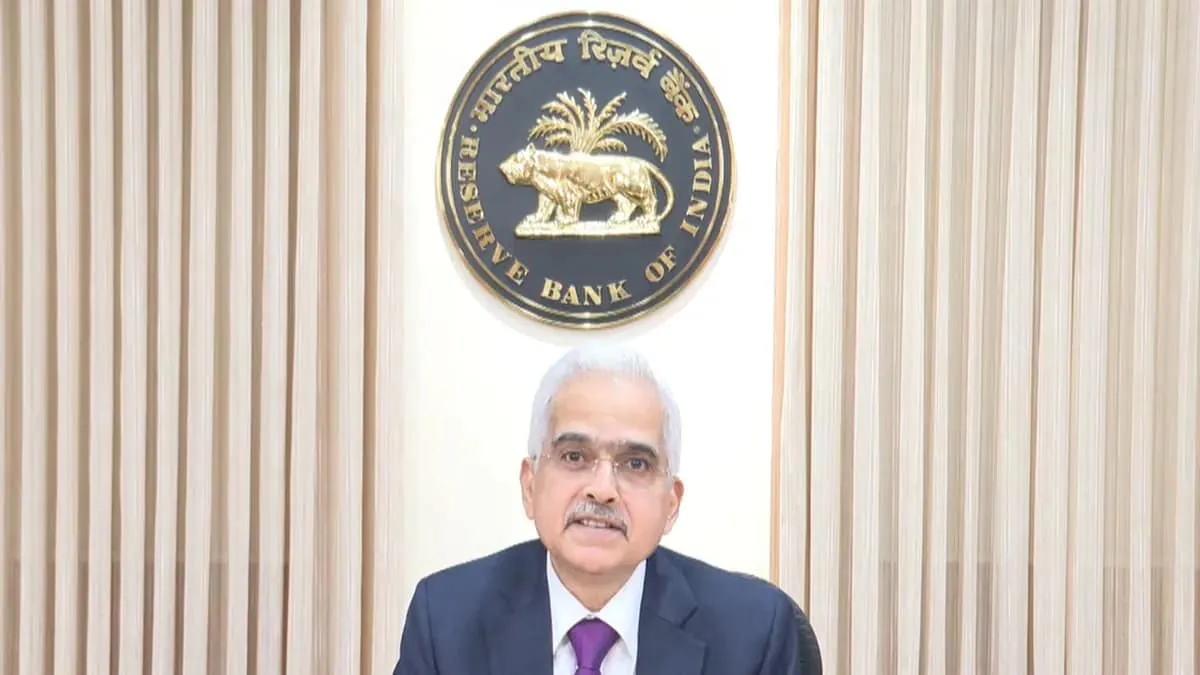

RBI MPC Meeting: Key Updates from Shaktikanta Das on Repo Rate and Inflation

RBI MPC Meeting: Live Updates on Monetary Policy

In the latest RBI MPC Meeting, Shaktikanta Das announced that the repo rate remains unchanged amid ongoing concerns surrounding CPI inflation and global economic pressure. The Reserve Bank of India's decision reflects a balanced approach in a climate of rising consumer prices and geopolitical uncertainties. This development keeps the repo rate steady at 6.50%, indicating a shift in stance from withdrawal of accommodation to neutral.

Implications of the Repo Rate Decision

- The unchanged repo rate signifies RBI's commitment to inflation control.

- A neutral stance opens avenues for potential interest rate cuts based on future economic data.

- The domestic economic outlook remains optimistic, supported by private consumption and investment.

In summary, the RBI's current stance underscores its dedication to maintaining economic stability and addressing inflationary pressures.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.