Taiwan Semiconductor: Buy Before Earnings Insights and Rating Upgrade

Why TSMC is Poised for Growth

Taiwan Semiconductor (NYSE: TSM) has exhibited remarkable strength in the financial markets, leading to its recent rating upgrade. Investors are keenly watching TSMC's upcoming earnings report as its trajectory reflects a substantial 25.5% return, significantly higher than the S&P 500's 8.84% gain.

Significant Market Trends

As TSMC approaches its long-term highs, several factors contribute to this bullish sentiment:

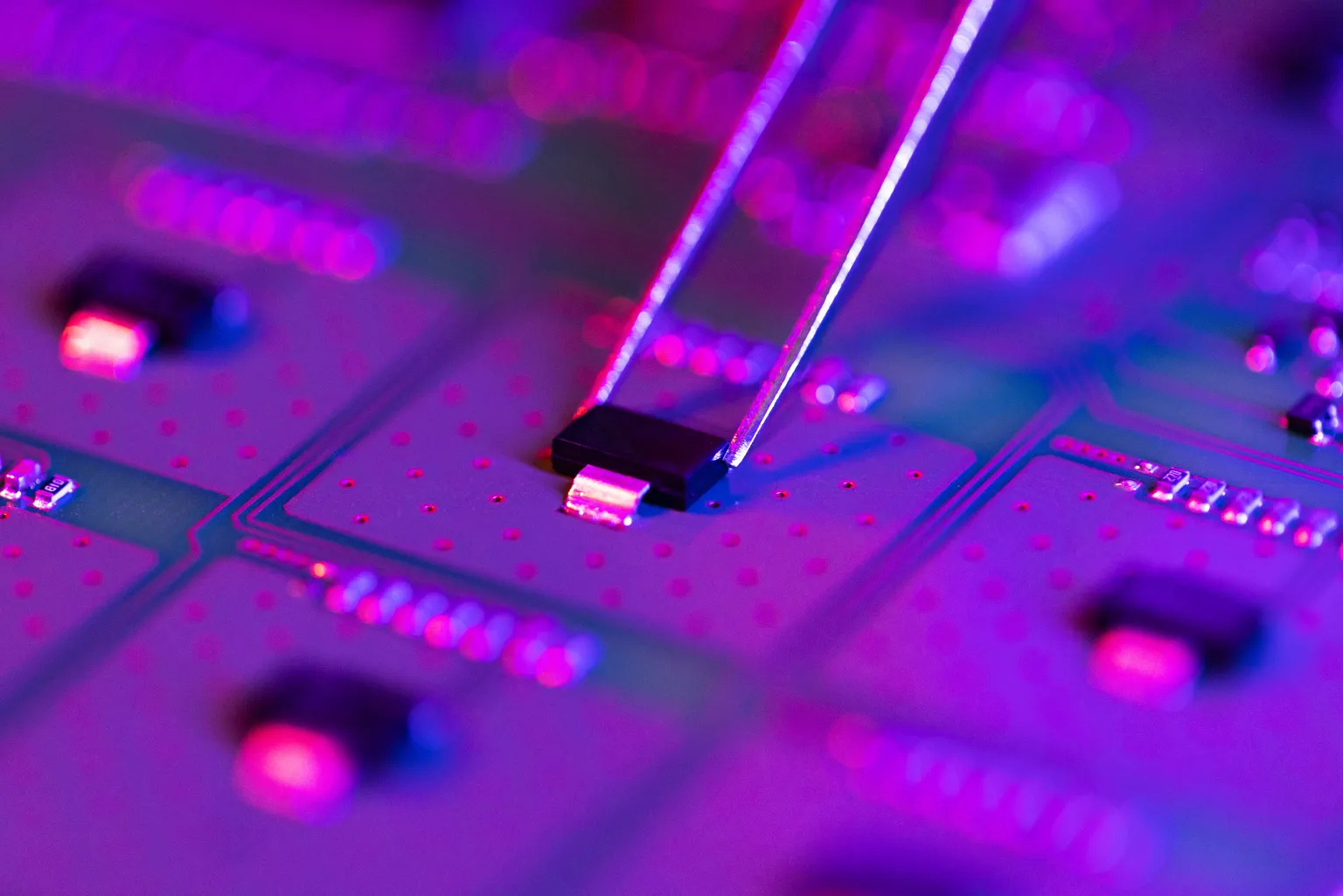

- Strong demand for semiconductors

- Technological advancements within the company

- Strategic partnerships driving growth

Investing in TSMC

The recent rating upgrade could attract additional investor interest in TSM, as analysts predict substantial growth in revenues. Those considering TSMC should keep a close watch on the earnings announcement, as it will provide critical insights into the company's performance.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.