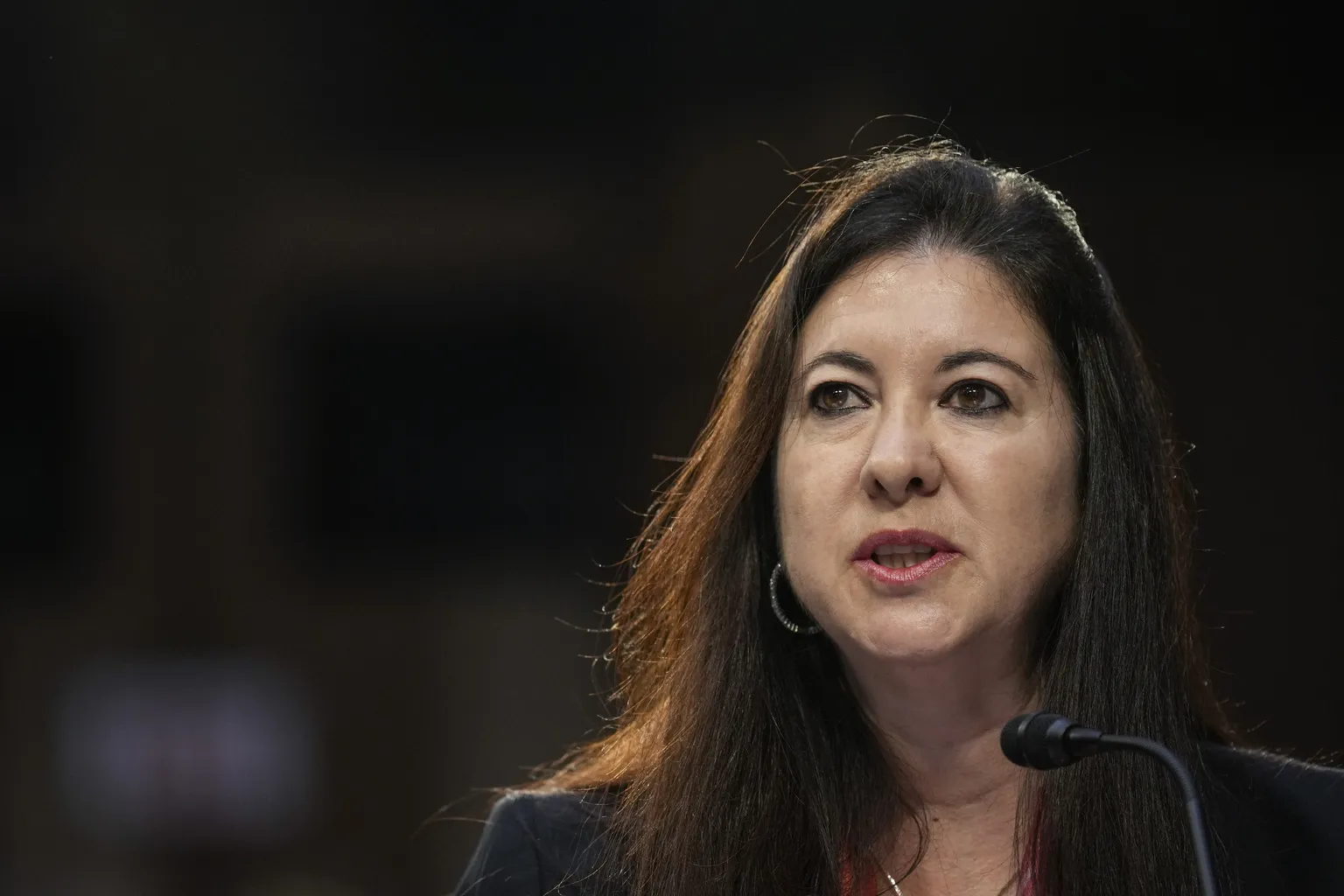

Fed Governor Kugler Advocates Rate Cuts Amid Continuing Disinflation

Fed Governor Kugler's Position on Rate Cuts

Federal Reserve Governor Adriana Kugler emphasizes the importance of disinflation in shaping future monetary policy decisions. If the trend of easing inflation persists, she supports the prospect of further rate cuts. This stance signals to the market the potential for lower borrowing costs which can invigorate economic activity.

The Implications of Disinflation

- Market Reaction: Financial markets generally respond positively to news of potential rate cuts.

- Investment Strategies: Investors might recalibrate their approaches in light of these developments.

Conclusion: Staying Alert to Policy Changes

As inflation continues to show signs of easing, stakeholders in various financial arenas must remain vigilant. Monitoring the Federal Reserve's actions will be crucial for understanding future economic trajectories.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.