Nvidia Stock Rises Amid Insights on Blackwell AI Chip Shipments

Nvidia Stock Rises and Blackwell AI Chip Developments

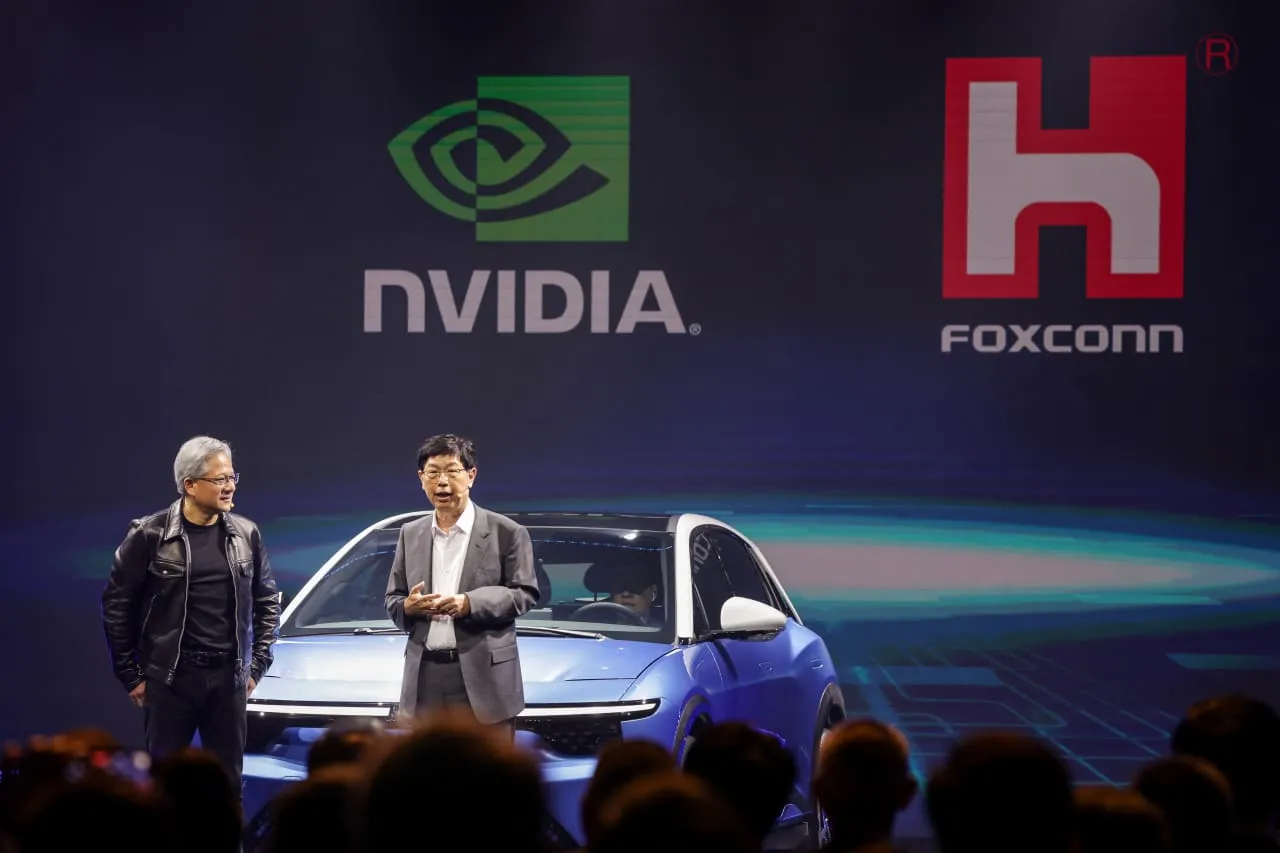

Taiwan's Foxconn announced plans to build the world's largest manufacturing site for servers dedicated to housing Nvidia's GB200 Superchips. This expansion demonstrates the increasing demand for AI technologies and the profound impact of semiconductors on the market.

Market Implications

The rise in Nvidia's stock reflects broader trends in consumer electronics and the accelerating pace of advancements in integrated circuits and computing. Investors are closely monitoring these developments as they shape opportunities in industrial electronics.

- Impact of AI on chip demand

- Foxconn's strategic move

- Market response to improvements

Analysts' Comments and Recommendations

Financial analysts are optimistic about Nvidia's future, highlighting the significance of the graphics processing units market and potential disruptions caused by competitor advancements such as those from Advanced Micro Devices and Microsoft.

Significance of Technological Advances

The evolving landscape of technology and consumer electronics continues to impact share price movements across the board. Companies investing in AI and semiconductor innovations will likely experience shifts in financial performance.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.