Target Corporation (TGT) Q1 2024 Performance Review

Quarterly numbers

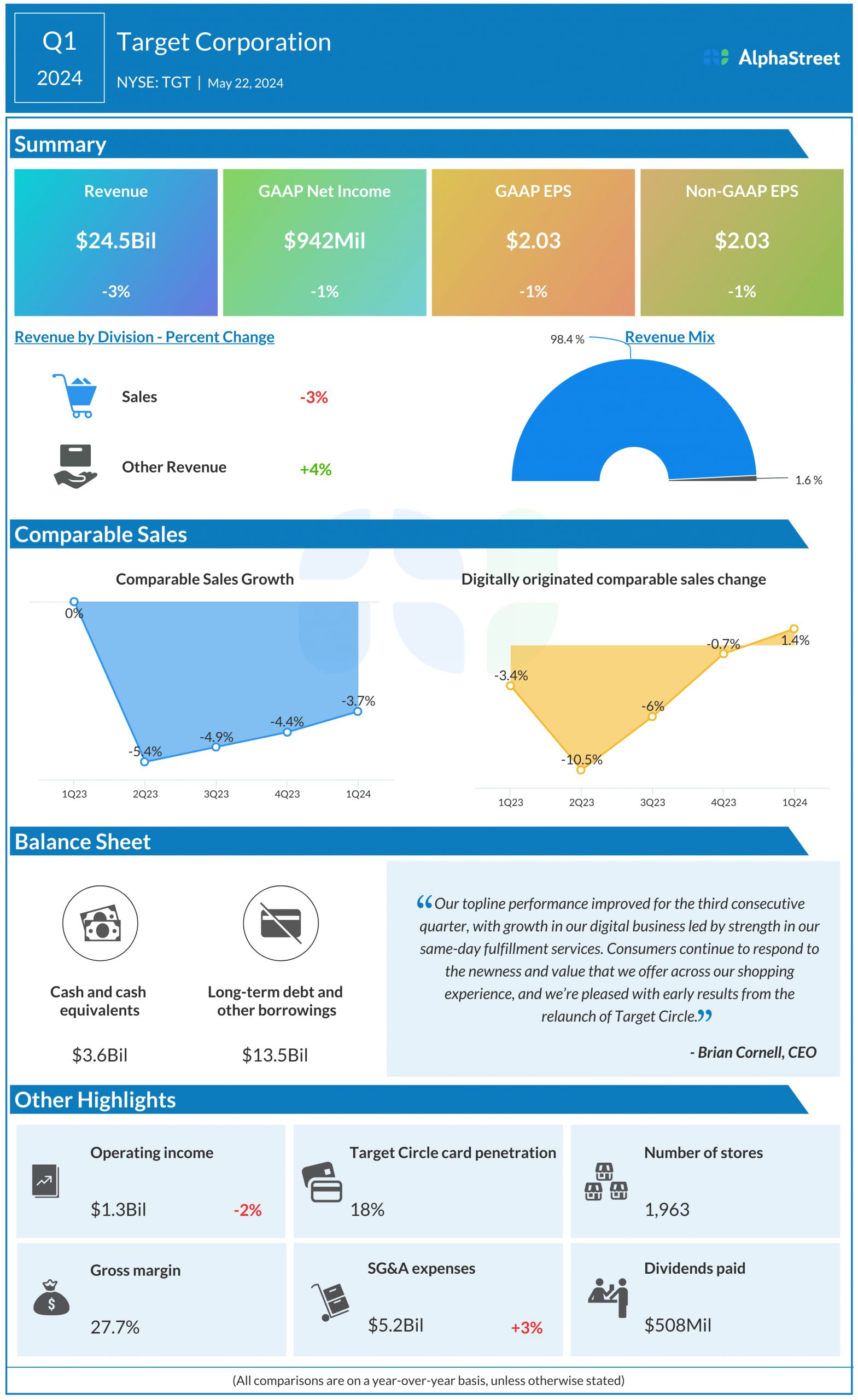

Target delivered mixed results for the first quarter of 2024 with total revenue declining 3.1% to $24.5 billion. GAAP EPS was $2.03, while adjusted EPS dropped 1% year-over-year.

Business performance

Target's Q1 comparable sales decreased by 3.7%, attributed to a drop in traffic and average transaction. The retailer noted challenges in discretionary categories and consumer behavior.

- Consumers are price-sensitive amid high costs and interest rates.

- Simple statements about pricing and customer trends.

Outlook

For the second quarter of 2024, Target anticipates modest sales growth and projects GAAP and adjusted EPS for the year.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.