Bitcoin Markets Drive Returns: Goldman Sachs Compares with Gold

Bitcoin Markets Surge YTD

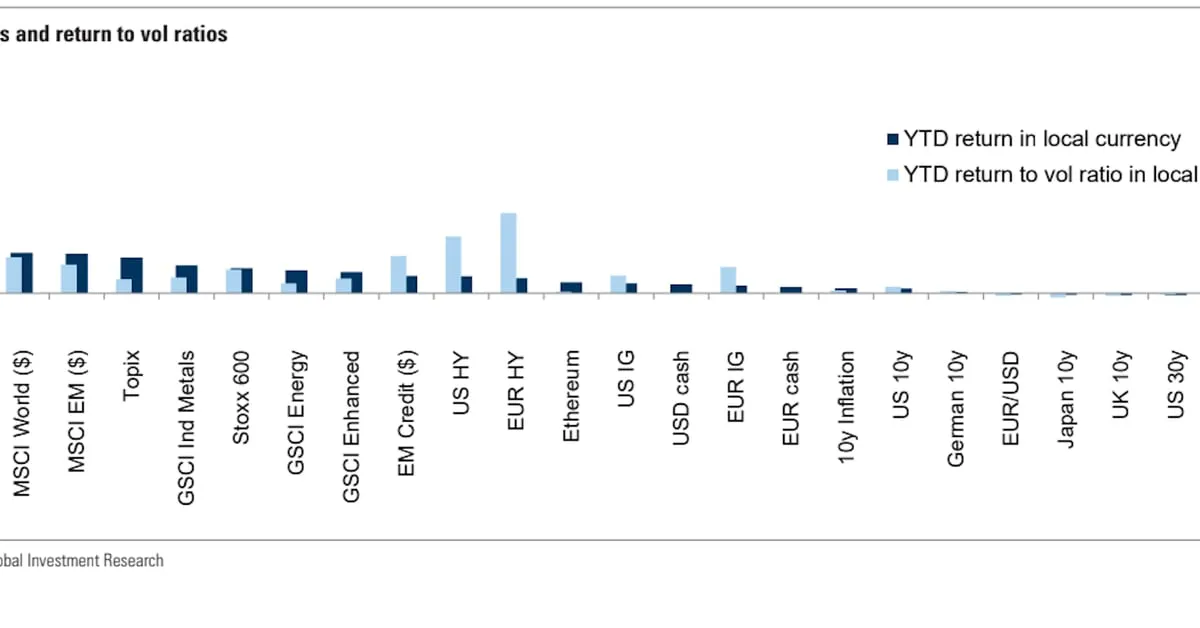

Bitcoin's performance has seen a remarkable uptick, registering a 40% increase year-to-date. According to recent insights from Goldman Sachs, this surge in bitcoin markets brings valuable opportunities for investors, yet the volatility presents inherent risks.

Gold's Resilience in Risk-Adjusted Returns

Despite the impressive numbers from bitcoin, gold holds its ground as a stable investment. Goldman Sachs' analysis reveals that gold consistently outperforms bitcoin on a risk-adjusted basis, making it a preferred option for those wary of market volatility.

Key Takeaways

- Bitcoin markets showcase a significant rise in returns.

- Gold demonstrates resilience on a risk-adjusted scale.

- Investors are advised to consider both *bitcoin* and *gold* in their portfolios.

Investment Strategies Moving Forward

As investors assess their options, understanding the comparative performance of bitcoin and gold in current markets is paramount. Continuous evaluation of these assets can lead to informed decision-making.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.