SOXX: Waiting for a More Attractive Valuation in the Semiconductor Market

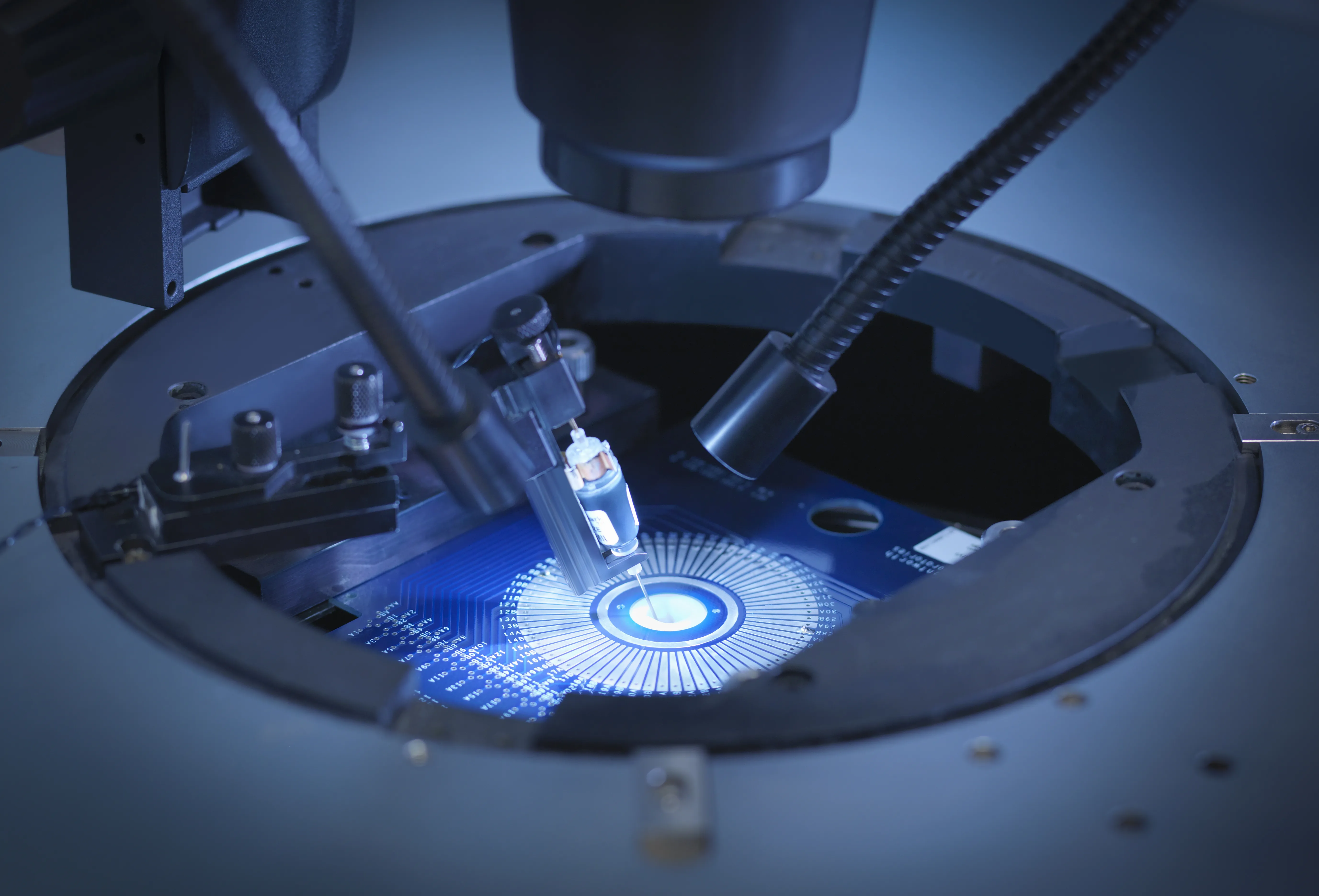

SOXX Semiconductor ETF Overview

The iShares Semiconductor ETF (SOXX) provides investors with diversified exposure to a range of leading semiconductor companies, making it an attractive option for those looking to tap into the tech-driven economy.

Key Features of SOXX

- Management Fee: 0.35%

- Beta: 1.59

- P/B Ratio: 5.25x

This fund has become a focal point for investors seeking quality in the semiconductor sector, although many are currently waiting for a more attractive valuation.

Why Valuation Matters

Valuation plays a critical role in the investment decision-making process. With volatile market dynamics, understanding when to enter a position in SOXX is crucial.

Exploring Market Trends

- Demand for semiconductors is rising rapidly across industries.

- Investors are cautious, looking for dips or more favorable entry points.

- Market analysts point to the historical performance of SOXX amid technological advancements.

Monitor market conditions to take advantage of potential opportunities within SOXX.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.