Taiwan Semiconductor: Strong Buy Signal Before Q3 Earnings Release

Taiwan Semiconductor’s Earnings Forecast

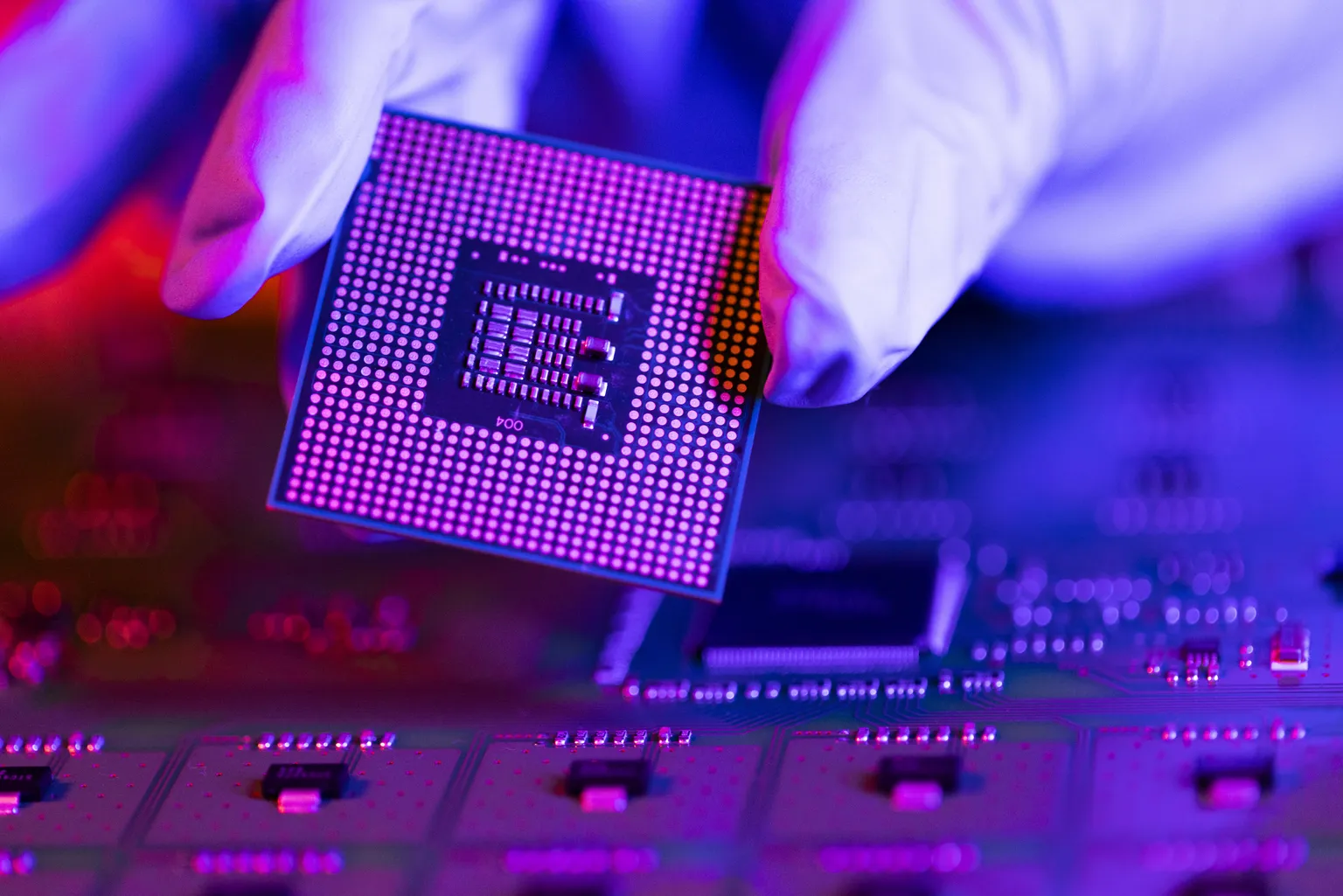

Taiwan Semiconductor Manufacturing Company (TSMC) stands as a titan in the semiconductor sector, showing promising growth ahead of its Q3 earnings release. Analysts anticipate strong earnings performance, attributing the potential for increased shareholder value to the heightened demand across various industries.

Reasons to Buy TSM Shares

- Increased Demand: The global chip shortage continues to drive the need for semiconductors.

- Investment in Technology: TSMC is heavily investing in advanced manufacturing capabilities to stay ahead.

- Diversification: Their broad client base across sectors mitigates risks.

Investor Sentiment and Market Position

With the upcoming earnings report, investor sentiment remains bullish. A strong performance can further solidify its standings in the stock market, making TSMC an attractive proposition for those looking to invest.

Conclusion

As the semiconductor market expands, Taiwan Semiconductor appears to be a strong buy opportunity before the Q3 earnings event. Take advantage of this chance to strengthen your portfolio.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.