China's Economic Stimulus Package: A Step Towards Recovery Amidst Global Financial Crisis

China's Economic Stimulus Package Explained

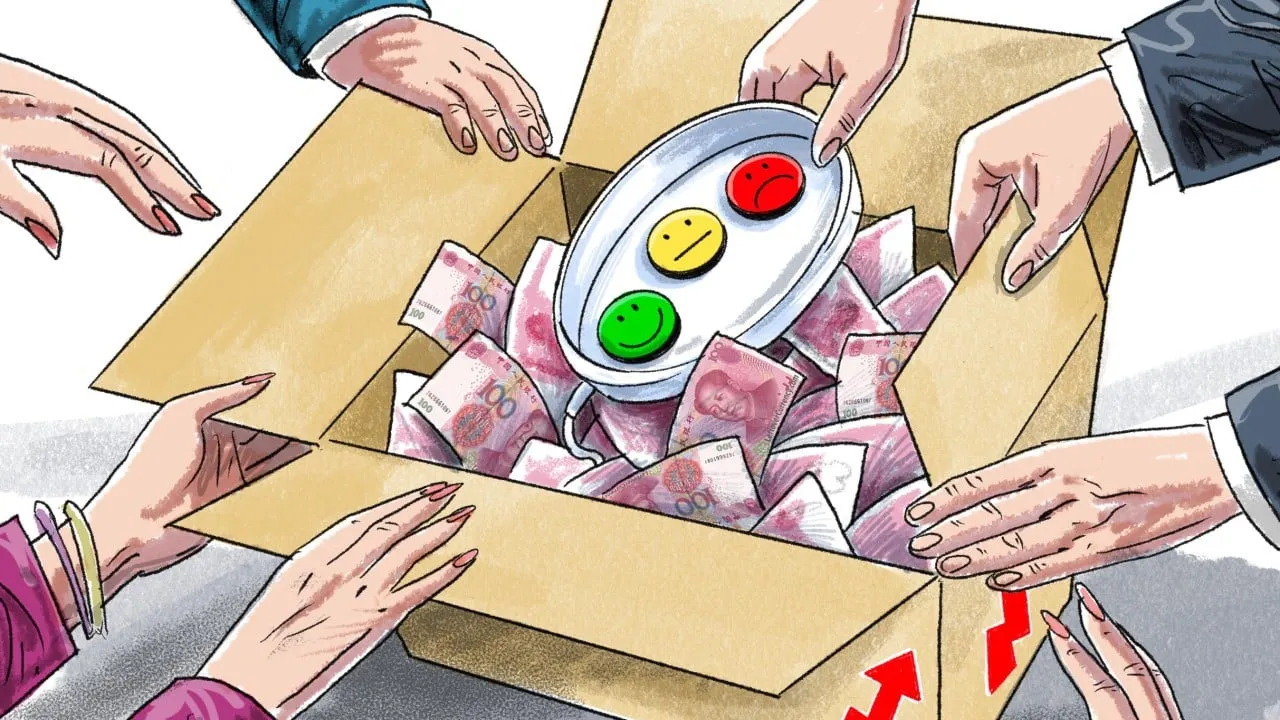

On September 24, China announced an economic stimulus package welcomed by markets, propelling the Shanghai A-share Index and Hang Seng Index upward by 21.4% and 15.8%, respectively. This unprecedented rise in asset prices has temporarily boosted household wealth, contributing to the wealth effect that may enhance consumption.

Impact on Domestic Demand and GDP

- The continued increase in asset prices may lead to greater household wealth.

- However, merely trading existing assets will not significantly contribute to GDP unless it increases demand for new assets.

- The overall health of China's economy in the coming months depends on whether this boost is sustainable or just a fleeting moment.

External Influences and Investor Sentiment

Since mid-2020, both the Hong Kong and Shanghai stock markets have trended downward, largely due to withdrawals by British and US institutional investors. There are concerns that recent price rises could serve as an exit point for these investors.

Rising Expectations for Household Consumption

- Increased consumption may stem from individual income tax rate reductions and heightened public goods consumption, such as in education.

- Changing expectations are critical, as self-fulfilling predictions can significantly influence consumption patterns.

Historical Context and Future Prospects

Historical examples hint at the power of government intervention, as evidenced during the Asian currency crisis and the 2008 global financial crisis. In 1992, reforms led by Deng Xiaoping restored confidence and sparked economic growth following negative expectations. Similarly, decisive actions during economic downturns showcase the Chinese government’s ability to stabilize sentiment.

Conclusion

Although it remains uncertain if the current stimulus package will be enough alone to recover the economy, it demonstrates the leadership's commitment to addressing economic challenges. Optimism persists regarding the fulfillment of the 5% growth target for this year, reflecting confidence in future government measures.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.