Tax Inflation and Capital Gains Tax in the United States Impacting Politics and Economy

Tax Inflation and Its Implications

Tax inflation affects individual income and influences government finances. The dynamics of capital gains tax in the United States are crucial as we consider tariffs and their role in policy decisions.

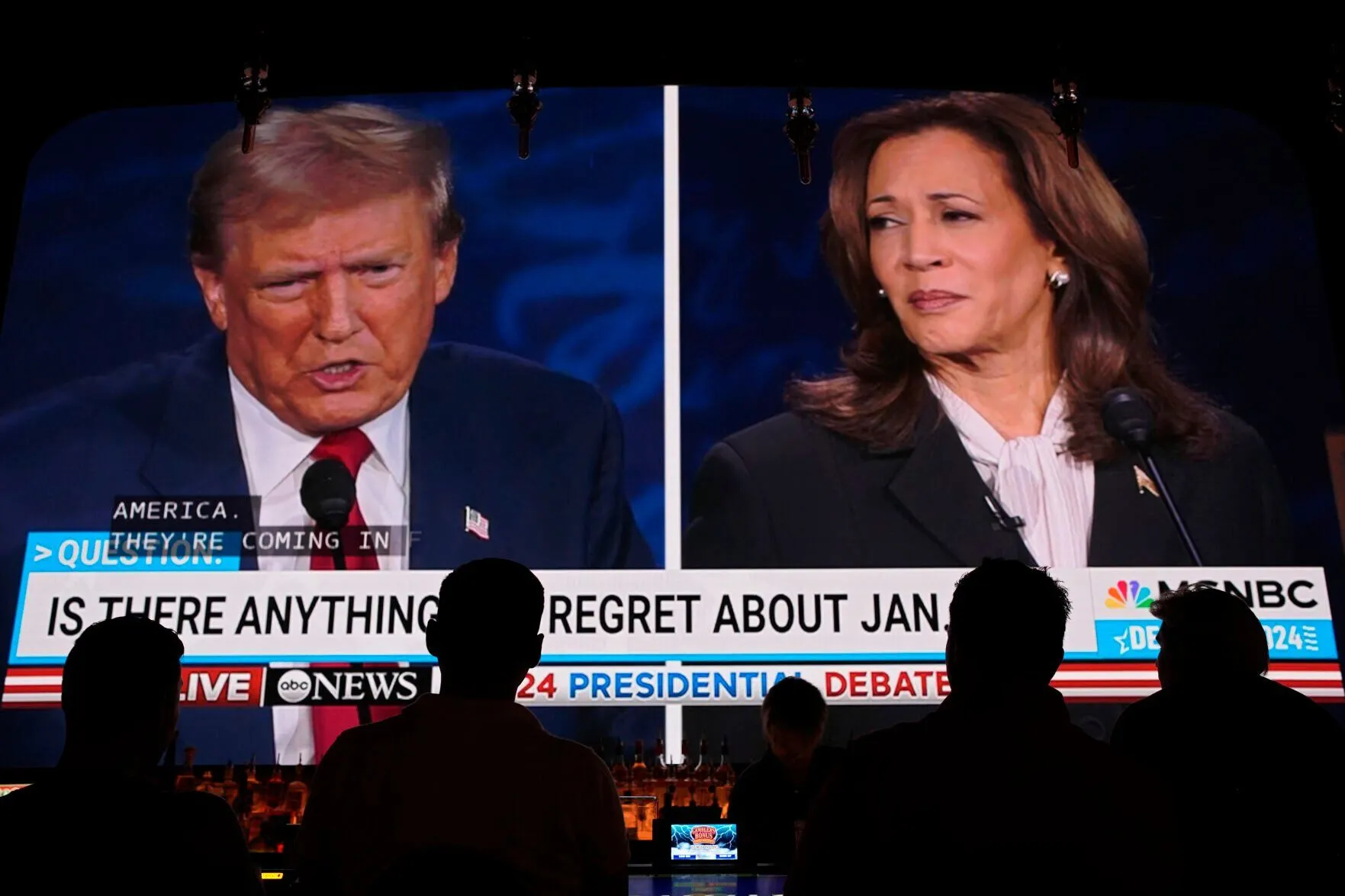

Political Influences on Economic Policy

- Joe Biden’s policies indicative of a shift in Democratic Party strategies.

- Donald Trump's previous decisions continue to echo in current economic discussions.

- The American Rescue Plan Act of 2021 and the American Recovery and Reinvestment Act of 2009 set important precedents for government actions.

- The Chips and Science Act signifies an ongoing commitment to shaping economic resilience.

Factors Beyond Policy

While markets may react to economic policies, external factors also play a significant role, especially during the 2021–2023 global supply chain crisis. Recognizing these elements aids in comprehending the full impact of recent tariffs and tax structures.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.