Hot Economy Could Be Good for Risk Assets Amidst Cool Inflation Trends

Current Economic Climate: Positive Surprises

Hot economy conditions could be good for risk assets if inflation remains controlled. Friday's jobs report revealed a better-than-expected snapshot of the U.S. labor market, leading to a 0.9% increase in the S&P 500, energizing market participants.

Economic Indicators: Shifting Trends

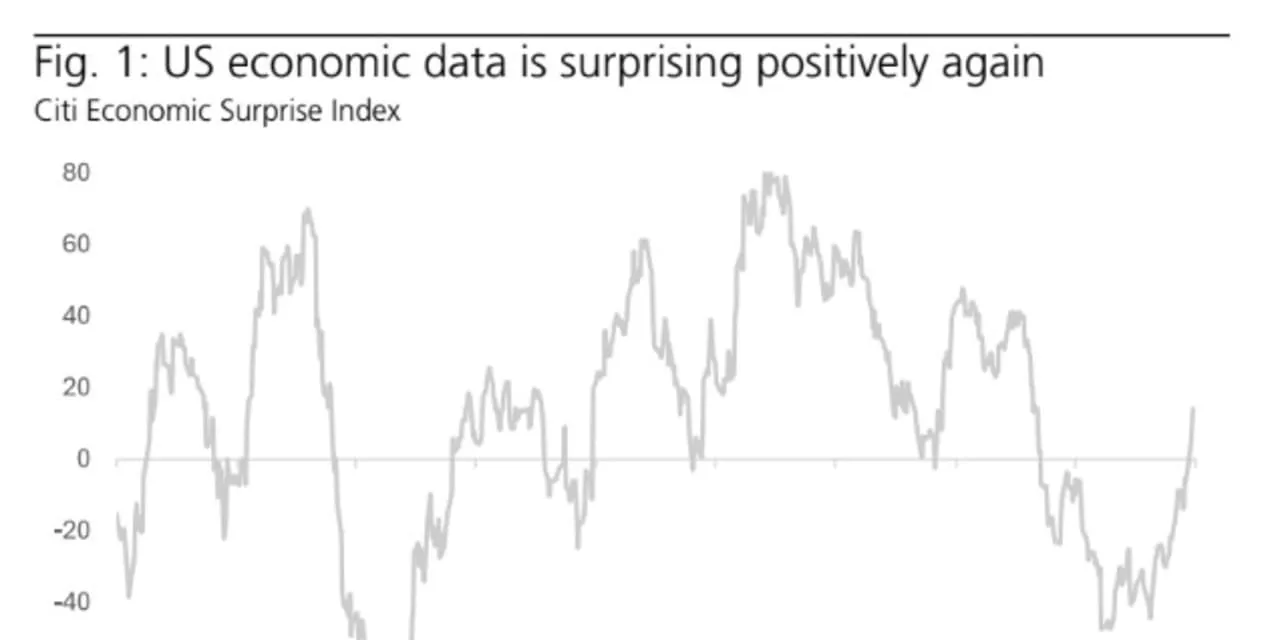

Moreover, key economic indicators have begun to produce stronger outcomes than anticipated. UBS has noted this trend, marking a sharp contrast to the weaker-than-expected surprises of previous seasons. Jason Draho, head of asset allocation at UBS, believes that these shifts increase the likelihood of a favorable outcome for *risk assets*.

Implications for Investors

- Watch for inflation trends that could impact asset performance.

- Monitor labor market data as a signal for continued economic strength.

- Consider diversifying into *risk assets* amidst these positive signals.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.