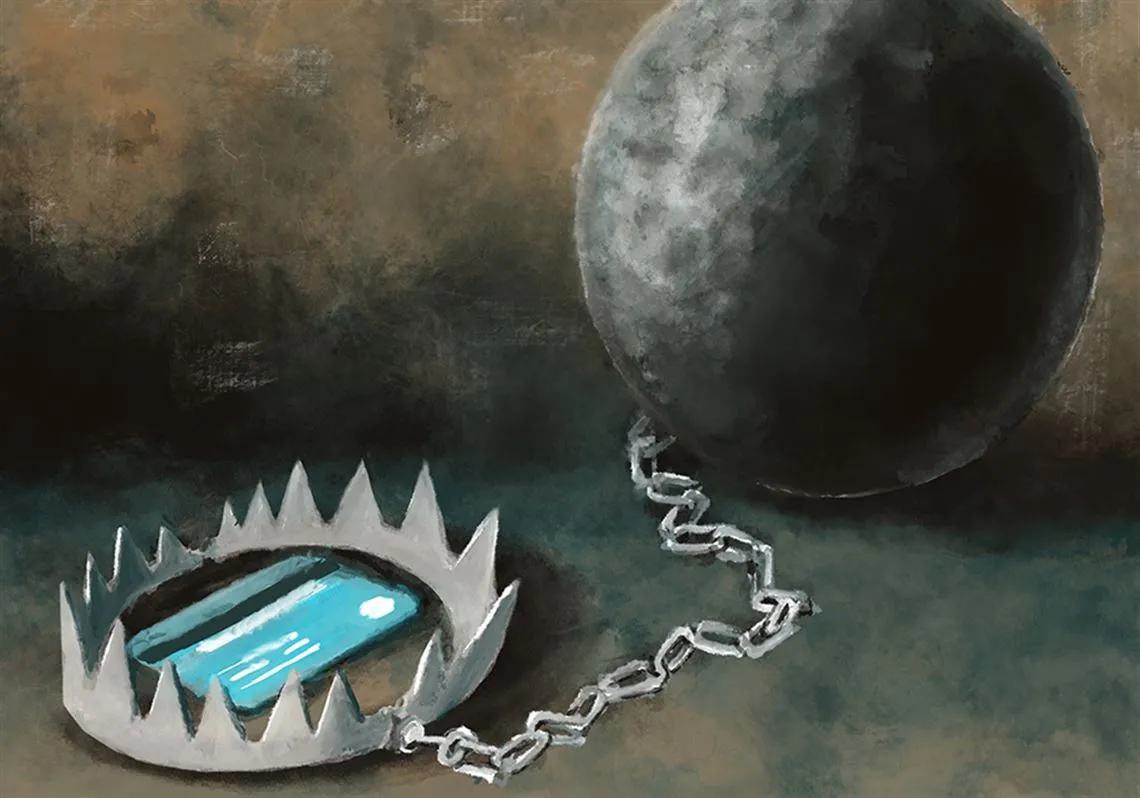

Retail Credit Card Interest Rates Soar Past 30%: Understanding the Impact

As retail credit card interest rates soar past 30%, consumers need to assess the real cost of discounts offered at checkout. This increase poses significant risks to personal finances. Understanding the implications of these rates is essential for responsible spending.

Financial Implications of High Interest Rates

High interest rates make it challenging for borrowers. Here are some critical points to consider:

- Increased Debt Burden: With interest rates exceeding 30%, the potential for accumulating debt is substantial.

- Annual Percentage Rate (APR) Awareness: Consumers must be cognizant of the APR on retail credit cards.

- Budgeting for Interest: It’s vital to factor in interest when planning purchases on credit.

Strategies to Manage Credit

To navigate these high rates, consider the following strategies:

- Pay Off Balances Quickly: Aim to pay off the balance each month to avoid interest charges.

- Limit Retail Credit Applications: Too many inquiries can hurt credit scores.

- Shop Smart: Weigh discount benefits against high interest rates carefully.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.