Analog Devices Inc. (ADI) Reports Sharp Decline in Q2 Revenue and Profit

Analog Devices Inc. (ADI) Q2 Earnings Decline

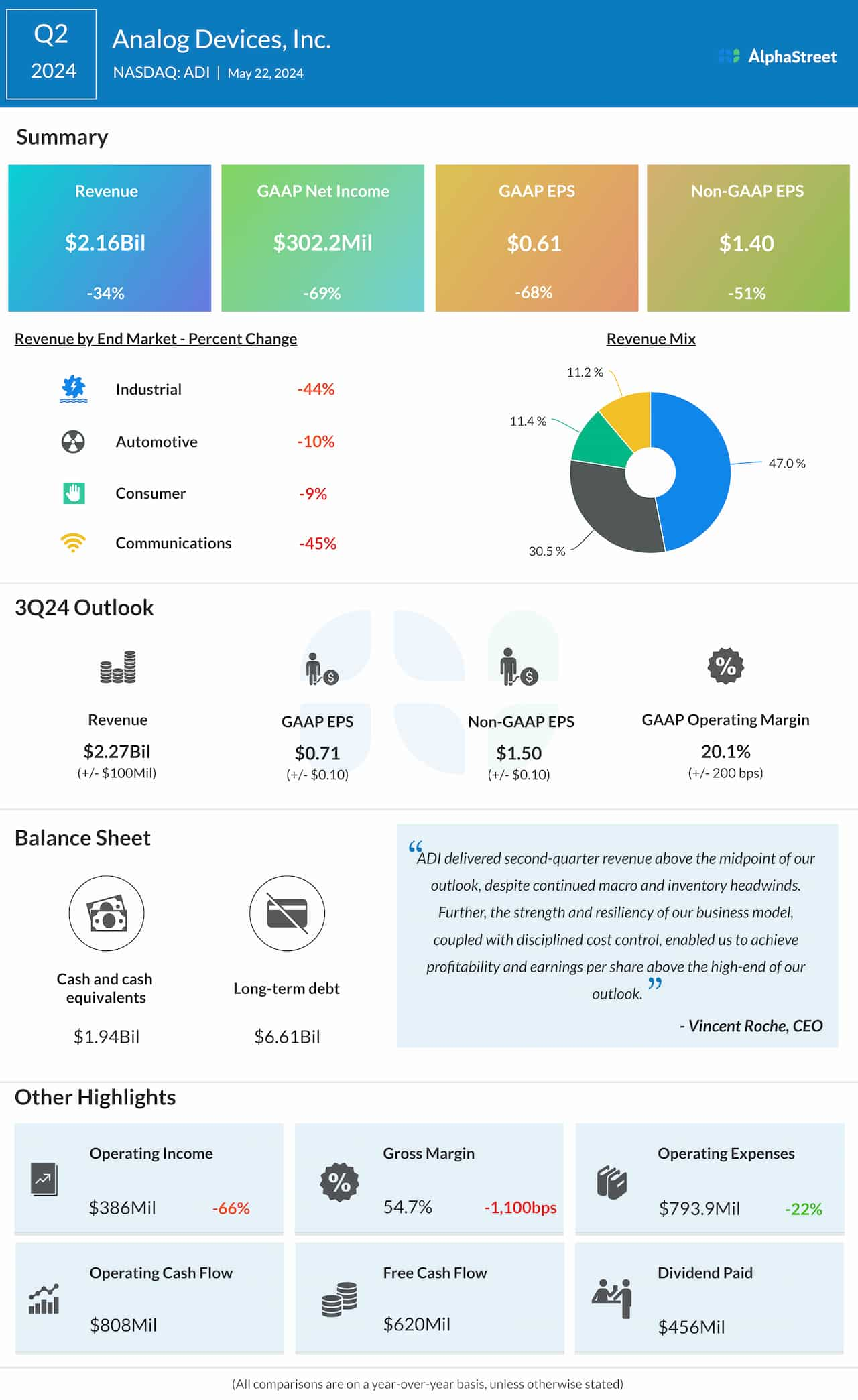

Semiconductor company Analog Devices, Inc. (NASDAQ: ADI) reported a sharp decline in revenues and adjusted profit for the second quarter of 2024. Second-quarter earnings, excluding special items, declined 51% year-over-year to $1.40 per share from $2.83 per share last year. On a reported basis, net income plunged to $302.2 million or $0.61 per share in the April quarter from $977.7 million or $1.92 per share in Q2 2023.

Impact on Bottom Line Performance

- The decline in revenues to $2.16 billion in Q2 from $3.26 billion in the prior-year period significantly affected the company's profitability.

Vincent Roche, the CEO of Analog Devices, highlighted the company's resilient business model and disciplined cost control as factors that enabled achieving profitability and earnings per share above the high end of expectations.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.