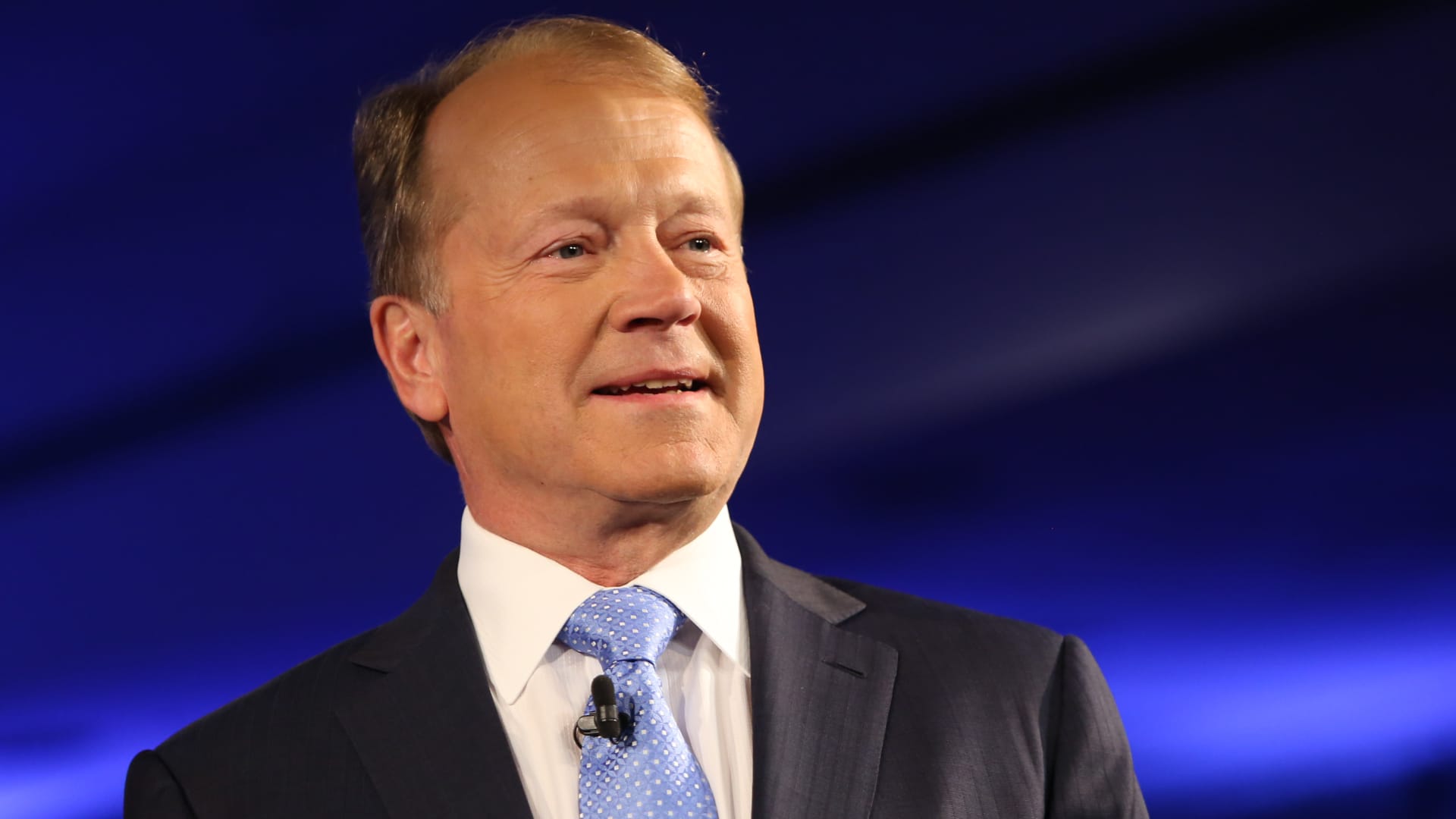

AI's Dominance in Stock Market for the Next Decade Forecasted by Former Cisco CEO

Artificial intelligence (AI) is set to revolutionize the stock market over the next decade, according to former Cisco CEO John Chambers. Speaking at the VivaTech conference, Chambers emphasized the transformative power of AI on financial markets, predicting that AI-related stocks will outperform non-AI stocks threefold. This substantial influence is already evident, with AI chipmaker Nvidia experiencing a fivefold increase in stock value since the end of 2022.

Chambers highlighted that 38% of venture capital in the U.S. during the first quarter of the year was invested in AI stocks, a figure expected to exceed 50% soon. In Europe, 12% of venture capital went into AI stocks, with predictions for significant growth. This surge in AI investment is attributed to its ability to determine winners and losers in the tech sector, similar to how Cisco’s position in the internet market set the stage for future trends.

AI's integration into financial markets is comparable to the internet's influence, yet Chambers believes it will be three to five times more potent. The stock market's dramatic movement in the last 12 months is largely because of AI, with the Nasdaq Composite and S&P 500 reaching new highs. He notes that AI’s impact will extend beyond technology, reshaping various sectors and driving job creation with enhanced value-added roles, despite eliminating some positions.

Nvidia’s position in the AI market serves as a barometer for the overall trend, mirroring Cisco’s role during the internet boom. The company’s significant rise in sales due to AI product demand reflects broader market patterns. Chambers asserts that investing consistently in a portfolio of AI stocks over the next five to 10 years promises substantial returns for investors.

Maurice Lévy, chairman of Publicis, affirms this optimistic outlook, suggesting that AI’s transformative impact will result in more job creation than losses. He urges companies to adopt AI early to maximize growth and innovation. The shift towards AI in financial markets is inevitable, with early adopters positioned to benefit the most.

As AI continues to integrate into trading and investment decisions, its influence on stock market trends is undeniable. The combination of increased venture capital investment and AI’s potential for reshaping industries underscores its dominance in the financial markets. Over the next decade, AI will not only drive market trends but also redefine the landscape of investment decisions and trading strategies, promising a future where artificial intelligence is at the core of financial market growth.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.

FAQ

What did the former Cisco CEO predict about AI's influence on the stock market?

John Chambers predicted that artificial intelligence will dominate the stock market over the next decade, driving significant growth and transforming financial markets.

Which AI company has seen a substantial increase in stock value?

AI chipmaker Nvidia has experienced a fivefold increase in stock value since the end of 2022.

How much venture capital in the U.S. was invested in AI stocks in the first quarter?

38% of venture capital in the U.S. during the first quarter was invested in AI stocks.

What is the expected impact of AI on job creation according to Maurice Lévy?

Maurice Lévy expects that AI will create more jobs with significant added value, despite eliminating some positions.

How does John Chambers compare AI's future impact to the internet's past influence?

Chambers believes that AI will be three to five times more powerful than the internet, transforming life in numerous ways.