Buying Gilead: Strong Outlook and Favorable Valuation Ahead

Reasons To Consider Buying Gilead

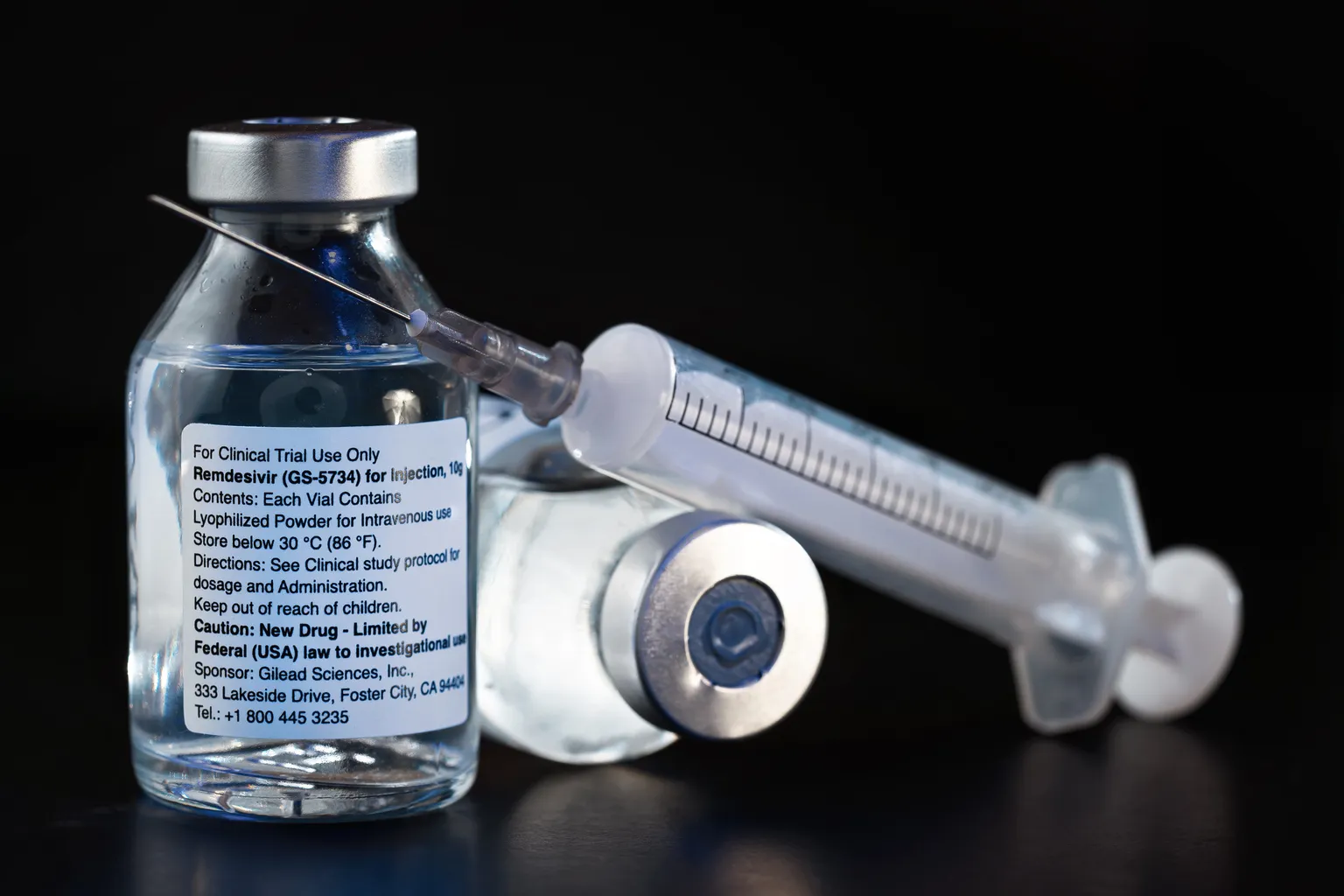

In the current financial landscape, Gilead Sciences presents itself as a compelling investment opportunity. With a strong outlook driven by potential blockbuster drugs in the fields of HIV and oncology, Gilead demonstrates solid growth prospects.

Favorable Valuation

Another factor enticing for investors is Gilead's favorable valuation. The stock appears priced attractively, allowing for potential upside as its product pipeline matures.

Robust Dividend Yield

In addition, Gilead offers a strong dividend yield, appealing to income-focused investors looking for reliable returns.

Exploring the Market

- Potential in HIV treatments

- Strong performance in oncology

- Attractive stock price

- Dependable dividends

Considering these factors, investors would benefit from evaluating Gilead's position in a diversified portfolio as its growth and valuation metrics align with current market trends. For more detailed insights, visit the source for comprehensive financial analysis.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.