Biden Administration's New Direct File Taxes Initiative: What California and 23 Other States Need to Know

Biden Administration's Initiative on Direct File Taxes

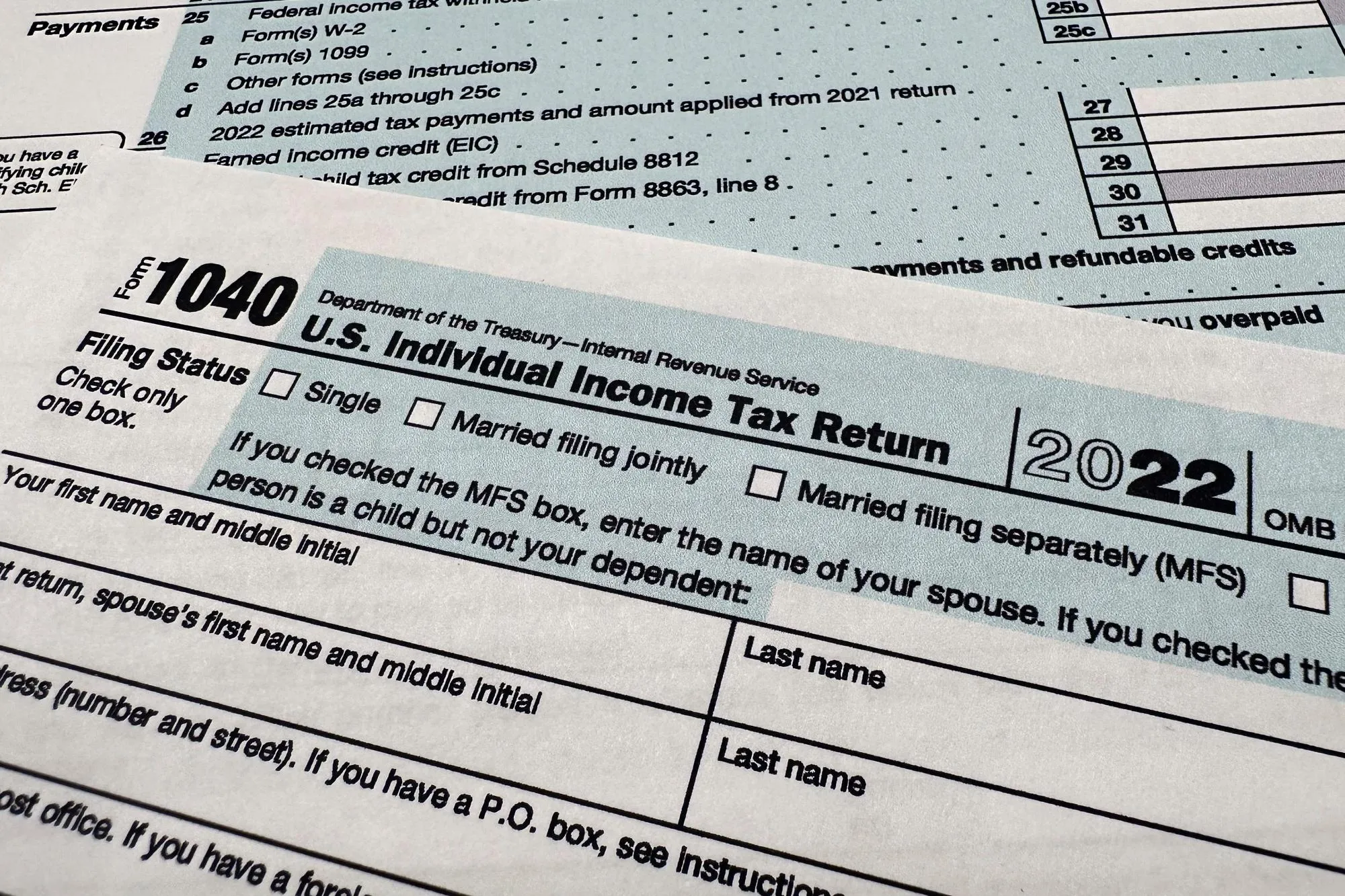

The Biden Administration has unveiled a groundbreaking plan to implement Direct File taxes for taxpayers in California and 23 other states by 2025. This initiative enables individuals to calculate and submit their tax returns directly to the IRS without the aid of commercial tax preparation software.

Benefits of Direct File Taxes

- Simplified Tax Filing: This program aims to streamline the process, making it more user-friendly.

- Cost-Effective Solution: By reducing the need for commercial software, taxpayers could save money.

- Increased Access: Targeting states with high populations ensures significant reach.

Implications for Taxpayers

California taxpayers, among others, can expect major changes in how they handle their federal tax returns. By directly interfacing with the IRS, individuals may find greater control over their filings while benefiting from enhanced efficiency.

Future Updates and Considerations

As the Biden Administration rolls out this initiative, it will be vital for taxpayers to stay informed about the specifics of the program and prepare for this substantial shift in tax filing procedures.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.