Insight on Cisco Systems Q3 Performance and Future Prospects

Impact of Cisco Systems Q3 Earnings

Cisco Systems Inc. (NASDAQ: CSCO) is set to release its Q3 2024 results, with expectations for a decline in adjusted earnings amidst ongoing market challenges.

Investment Focus on AI and Customer Experience

Cisco is enhancing its AI capabilities and customer experience to remain competitive in the market, despite facing cautious customer spending and reduced workforce in recent months.

Q3 Report Expectations

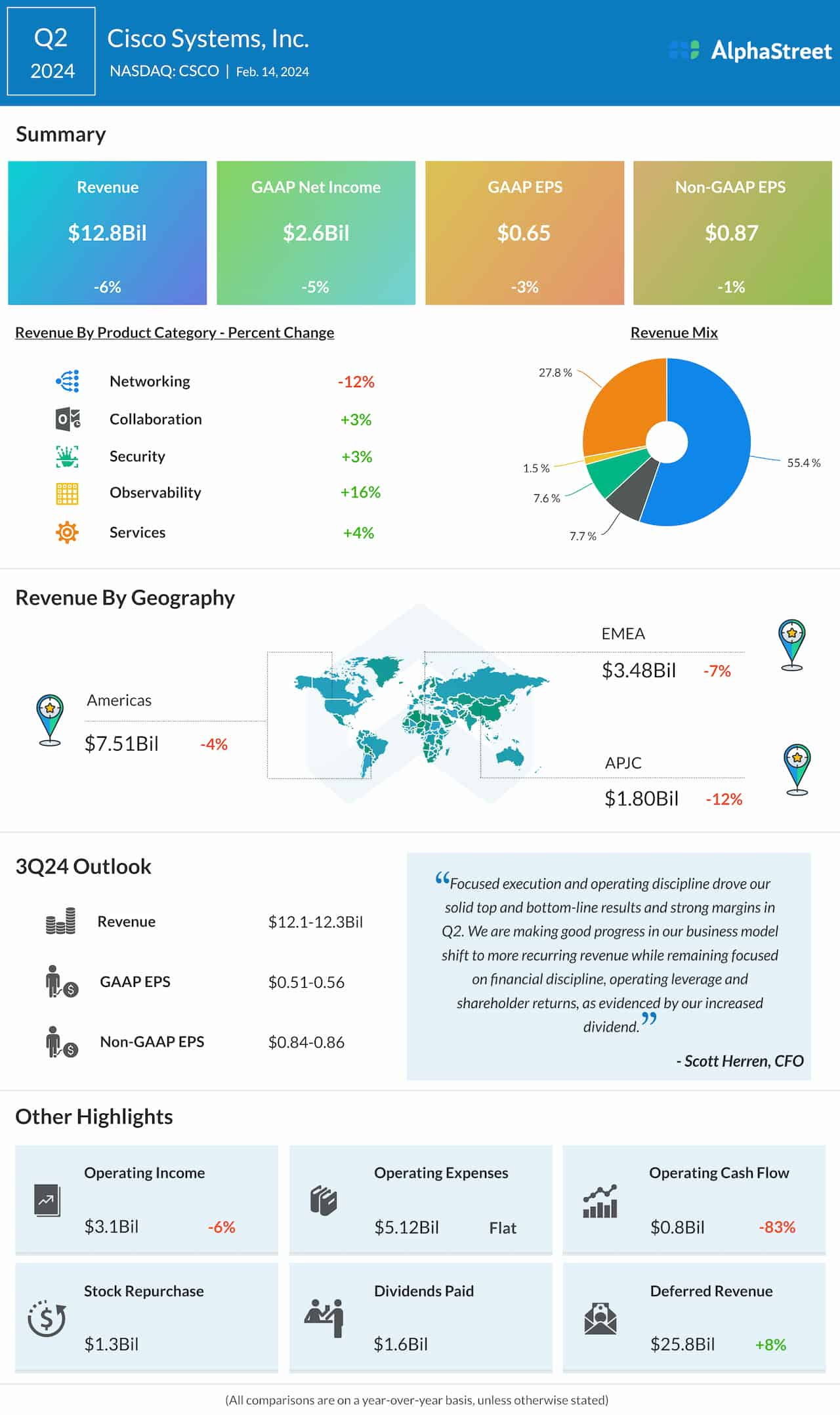

- Analysts predict earnings of $0.77 per share and revenues of $11.6 billion for the quarter.

- Cisco aims for revenues in the range of $12.1-$12.3 billion, with Q3 earnings and adjusted earnings forecasts in the range of $0.51-$0.56 per share and $0.84-$0.86 per share, respectively.

Recent Developments and Expansion

Cisco's recent acquisition of Splunk for $28 billion and the launch of HyperShield reflect its efforts to enhance cybersecurity and generative AI capabilities, positioning itself against rivals like Google and Microsoft.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.