Short-Term Bitcoin Holders Are Losing Big as Mideast Tensions Escalate

Market Reactions to Mideast Tensions

As geopolitical tensions rise in the Middle East, short-term holders are forced to liquidate their Bitcoin holdings, sending a staggering $3 billion to exchanges. This is a clear reaction to market sentiment shifting rapidly due to global uncertainties.

Impact on Bitcoin Prices

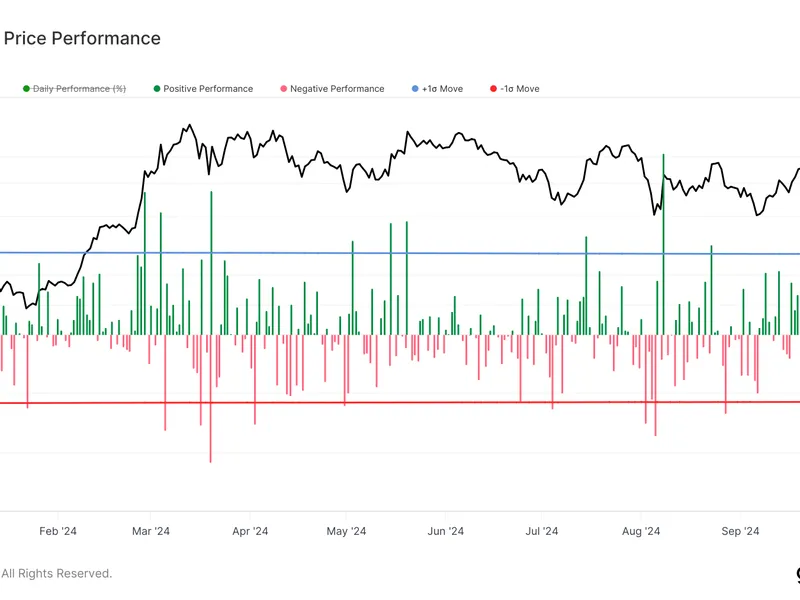

In just a few days, Bitcoin has recorded back-to-back declines of 3.7%, indicating significant investor caution. The movement of funds from long-term strategies to immediate exchange liquidity adds pressure on prices.

Investors' Increasing Caution

- Short-Term Trading Strategy: With elevated geopolitical risks, many investors are opting for quick trades.

- Market Volatility: Ongoing tensions could lead to further fluctuations in cryptocurrency valuations.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.