International Relations: The Modest Impact of the Iran-Israel Proxy War on Oil Prices

International Relations and Oil Price Modulation

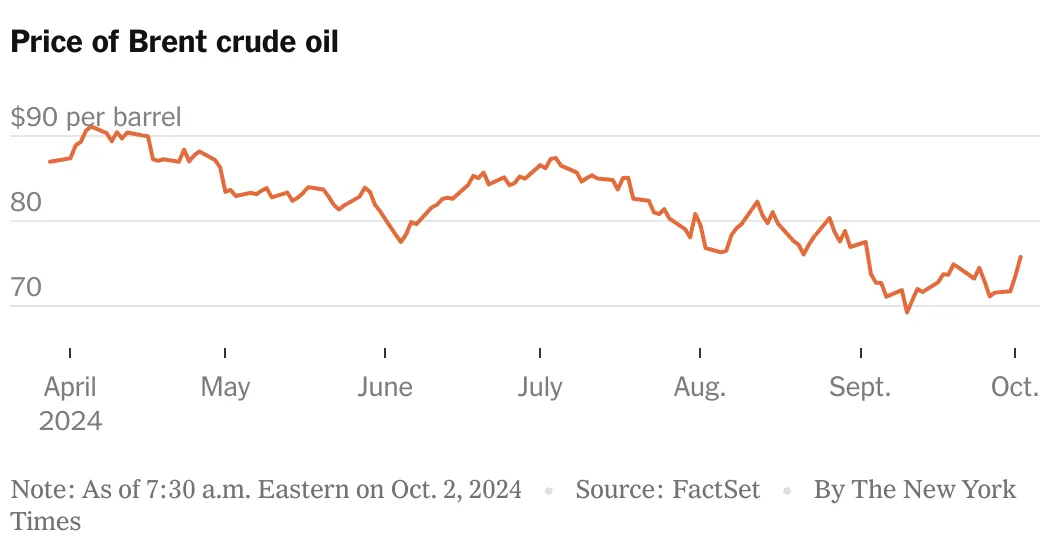

The ongoing Iran-Israel shadow war has heightened investor concerns regarding the stability of oil and gasoline prices. The conflict's geopolitical context forces traders to weigh price fluctuations against fundamental supply and demand metrics.

Global Production vs. Demand Shifts

- Enhanced global oil production has served as a buffer against potential supply disruptions.

- Simultaneously, slowing demand in key markets like China further mitigates the pressure on prices.

Market Responses and Future Outlook

As strategies and power plays unfold in this Iran-Israel cold war, market analysts are keenly observing the oil price implications. The overall sentiment suggests a nuanced landscape where fears of supply disruptions do not translate into substantial price increases. Investors should remain educated about the nuanced factors influencing oil markets.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.